A few things on my radar #8

Atour; Apple; Freshippo

👋 Hello hello! Thanks for reading The Momentum. Subscribe for free to receive new posts and support my work!

Atour

Atour(NASDAQ:ATAT), a fast-growing Chinese hotel chain making waves domestically, despite limited media attention

As of late 2023, Atour stands as China's premier upper midscale hospitality provider, leading the market in total room capacity. The company has distinguished itself by pioneering an innovative retail integration model within the Chinese hospitality sector, according to Frost & Sullivan.

The company quietly listed on NASDAQ in 2022, becoming a reopening stock that benefited from Beijing's relaxation of Covid restrictions. As of June that year, Atour operated 834 hotels across 151 cities in China.

As of September 30, 2024, Atour's hotel network boasted a total of 1,533 hotels or 175,199 hotel rooms in operation, witnessing robust year-over-year boosts of 37.9% and 36.1% in terms of the number of hotels and hotel rooms respectively, according to Atour report.

Atour net revenues for the third quarter of 2024 increased by 46.7% to $271 million yoy, primarily driven by growth in managed hotel and retail businesses. Notably, retail business, including bedding, bathing and perfume products, accounts for 25% of total revenue.

“ATAT’s current valuation reflects its solid performance, but the potential for significant upside remains. With continued growth and strategic expansion, ATAT is poised to narrow the gap with industry leaders and achieve higher valuations.” said Alvin Chow, author at Growth Dragon.

Based on my personal experience, Atour's success stems from prioritizing guest experience over basic hotel operations. Unlike other hotels' standardized approach, Atour delivers personalized service—they'll pre-warm rooms for temperature-sensitive guests, proactively check on guests who appear dissatisfied, and even accompany ill guests to the doctor. This exceptional care builds customer trust, making guests more receptive to Atour's retail products. The result is a seamless ecosystem where hospitality and retail business reinforce each other.

However, this extreme focus on user experience may be built upon sacrificing employee wellbeing - I have noticed that some employees of Atour are complaining about the company culture online. "The customer experience is great, but they're very unfriendly to employees. Management's style is all about yelling and docking pay. One person has to do the work of two or three people, sacrificing themselves for just a few thousand yuan monthly salary." a comment online.

It seems that they are in a similar situation as Manner - rapid expansion and pursuit of customer experience has led them to neglect the interests of frontline low-paid employees. If true, this toxic culture could be a ticking time bomb - burning out employees, causing staff turnover, and even public condemnation, ultimately damaging the brand's reputation.

Apple

Apple seeks to stop sales decline in China after experiencing falling sales for over a year

According to analysis by Counterpoint, Apple's China market share fell to fourth place in Q4 2024, with sales dropping 18.2% year-over-year. Annual sales declined 12.6% to 15.5%, while Huawei rose to first place with 31.3% market share.

Apple is now in discussions with Tencent and ByteDance to develop AI features specifically for iPhones in China, Reuters reports, citing three sources.

To drive sales, in October last year, Apple cut iPhone 16 prices at its Tmall flagship store in China for Double 11, barely a month after launch, said Yicai.

Moreover, Apple implemented price cuts on some key devices from $60-$100 yuan in mainland China from January 4th-7th to compete with Huawei and other local rivals in the world's largest smartphone market, reported by SCMP.

On January 18th, Apple opened its 58th store in Greater China in Hefei, Anhui Province, demonstrating its continued investment in inland market growth opportunities, said Jiemian News, a Chinese business news outlet.

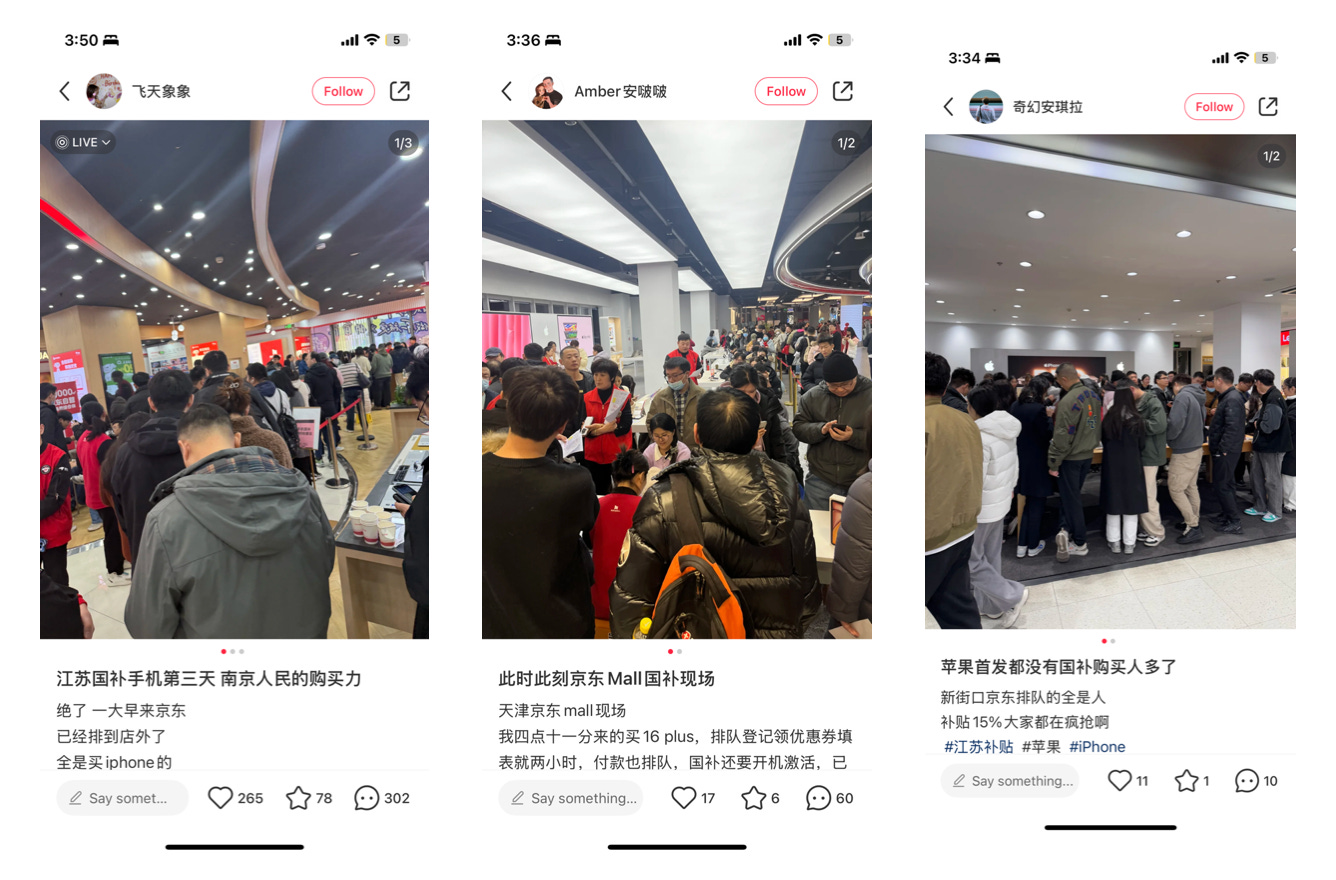

Since late last year, many Apple models have been participating in a series of government-driven subsidy programs - including province-level subsidies that started at the end of last year and national-level subsidies that began at the start of early this year. Currently, some stores appear to be able to apply both subsidies simultaneously.

As I mentioned in April last year, Apple's current decline simply represents a return of market share gained during sanctions back to Huawei — Current market data shows Apple at 15% (up from 9% pre-sanctions) while Huawei holds 31.3% (down from 35%) — I think this level of decline should be within Apple's acceptable range.

Currently, Apple maintains differentiation compared to local competitors with advantages in chip technology, hardware-software integration, and its cross-device ecosystem. In the short term, even without AI features, Apple's core product remain distinct and hard to duplicate—the company continues to set technical standards for the industry.

Building on these fundamentals, Apple's ongoing marketing initiatives—including new store openings, price reductions, and participation in government subsidies—could help it maintain stronger market presence than its pre-sanctions levels. This outlook holds true unless the company encounters new political hurdles or Huawei achieves major technological advances.

Freshippo

Freshippo, Alibaba Group's grocery chain subsidiary, achieved nine consecutive months of profitability, announced the CEO on the final day of 2024

Freshippo, China's first data and technology-driven new retail platform, grocery chain delayed its IPO in 2023, with Alibaba chairman Joe Tsai stating no immediate listing plans.

Since last year, Alibaba stated that they would return to its core e-commerce business and sell non-core operations. After Alibaba sold loss-making businesses like Intime (银泰) and Sun Art (高鑫), Freshippo, which experienced massive store closures and layoffs, was also rumored a potential candidate for sale.

Yan Xiaolei, who took over as Freshippo's new CEO in March last year, initiated a series of reforms. She focused the previously scattered business operations on two core store formats— Fresh Food and Neighborhood Business — and achieved 9 consecutive months of profitability. During an internal meeting, she announced that Freshippo would not be sold, news that was later confirmed by an Alibaba employee.

During 2024, the supermarket opened 72 new stores—averaging one new store every 5 days—and entered 21 new cities, according to Yan's letter. This marked its fastest growth phase in five years, bringing the total number of Freshippo outlets to 400 across 50 cities.

In Jun last year, the brand rolled out a selection of its private label products at 99 Ranch Market, the largest Chinese supermarket chain in the U.S., and online via Asian goods retailer Yamibuy. The launch marks the first time a domestic Chinese grocery store has exported its self-branded products overseas at a large scale, said Alizila, an Alibaba owned media outlet.

Although Yan has helped Freshippo achieve profitability and claims it won't be sold, the final decision lies with higher management — Joe Tsai will need to evaluate both the sustainability of its profitability and how well it fits into Alibaba's broader strategic vision.

Big picture, the grocery chain competition is hot in China right now. International brands like Sam's Club, Aldi, and Metro are expanding rapidly, while besides Freshippo, domestic players such as JD, Missfresh (backed by Tencent), Xiaoxiang (Meituan owned), and Dingdong (backed by Capital Today and Sequoia Capital) are also in the mix - perhaps I'll write some dedicated articles analyzing these in more detail later.