In the shadow of Huawei's comeback: Is Apple a victim or beneficiary?

What media got wrong in its coverage of Apple in China.

Much media coverage has painted Apple as a victim of Huawei’s recent comeback, but a closer look at the data indicates the opposite is true.

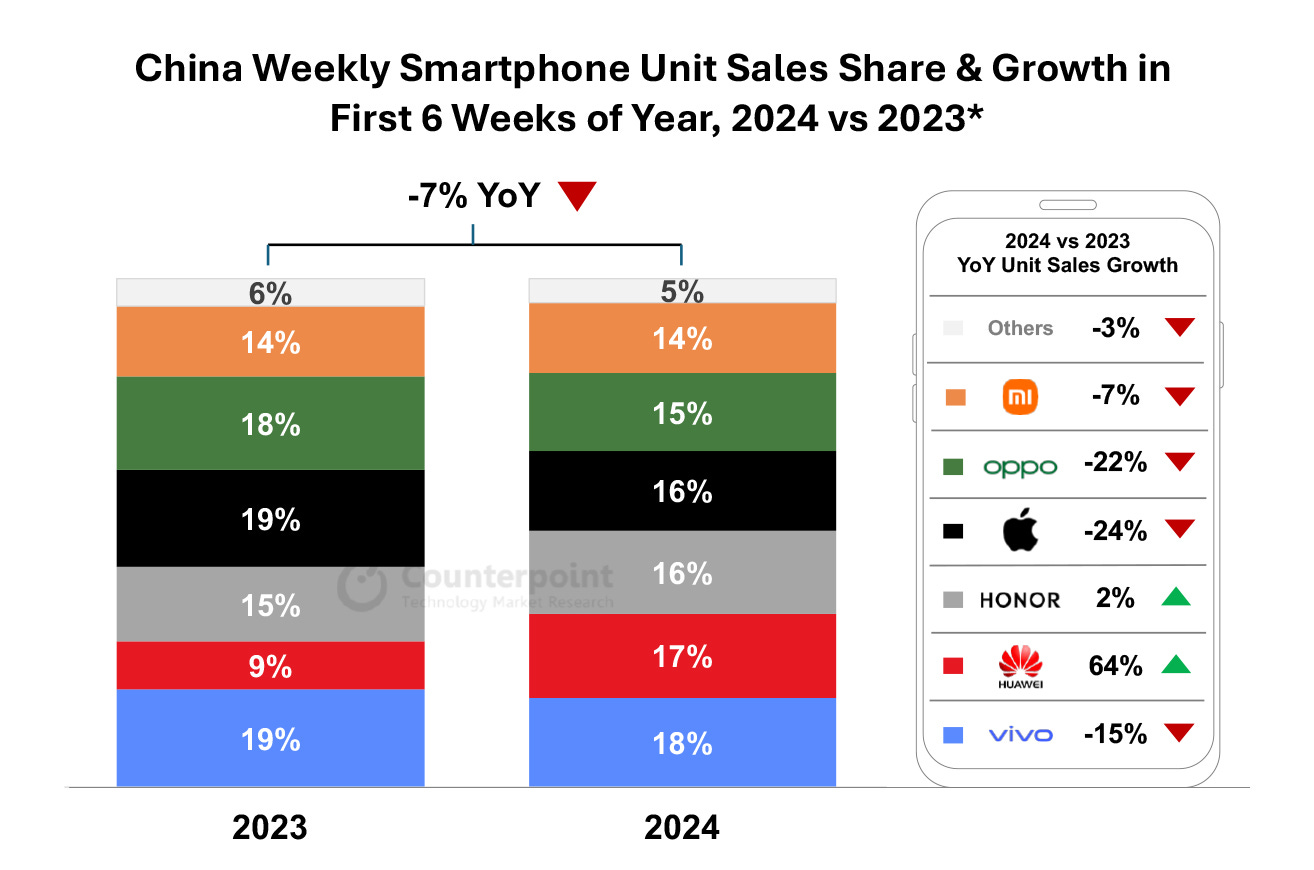

Yes, after Huawei returned to the market in the fourth quarter of last year, Apple's sales fluctuated — from a 2% decline in Q4 2023 to a 24% drop in the first six weeks of the Q1 2024.

However, I disagree with overly pessimistic speculations like "Apple is struggling in China," "The iPhone is losing its charm," and "China is cracking down hard on Apple," which are frequently heard in public.

In my view, even with such a huge drop, Apple still holds its ground as the top beneficiary in the Chinese market. If we look at the data from the last three years – from before Huawei was sanctioned to now, instead of just looking at the present, it paints a completely different story.

What is the historical context about Apple's decline?

Over the past three years, Apple has capitalized on the absence of Huawei. And it even reached an all-time high in Q4 of 2022, when Apple acquired 23% market share, ranking first among all brands.

When Huawei re-entered the market, they start to recoop the shares that they had lost.

From 2019 to 2024, Apple's market share has seen a noticeable increase, moving from 9% to 16%. Huawei (including Honor) and vivo market shares are stable compared to 2019 data. However, OPPO and “other brands” have both declined, with market shares dropping from 19% to 15% and 9% to 5%, respectively.

That is to say — despite facing a 24% decline after Huawei's return, Apple remains third in the market.

Don't forget, in 2019, Apple was ranked just sixth (the table shows it as fifth because Huawei's statistics at that time did not exclude Honor).

In the end, the real casualties of this market are OPPO and other less competitive players.

Besides, Apple's real sales season is not in the first quarter, but rather the third and fourth quarters. So, there is still ample time for adjustments — they are already taking action.

What is Apple doing in response?

In response to the downward trend, Apple has doubled down its investment in the Chinese market.

New promotional campaigns, such as more appealing trade-in promotions and Chinese New Year discounts, coupled with increased social buzz from Cook's visit and a rise in digital advertising, indicate an upswing in Apple's local PR and marketing efforts, which is likely to drive revenue growth.

Product-wise, Apple is on the verge of launching Vision Pro in China, a crucial step for their business expansion. Given the population's slight addiction to technology, a walking-TV might not be a hard sell for Chinese consumers, potentially making it a home run for Apple.

Not to mention, Apple’s newly opened flagship store at Jing'an Temple could become a new landmark in Shanghai. With its great location and sophisticated design, it cwould strengthen Apple's competitive image.

A university student from Shanghai who visited the Apple Jing'an Temple flagship store said:

I've always used Meizu (a local niche brand) phones, but I'm ready to switch to Apple because the Apple system seems very easy to use. You know, the Meizu phone starts to lag after a while, which makes me very uncomfortable. Although Apple appears expensive, its cost performance is actually quite high when you take its experience and lifespan into consideration.

What is CCP’s stance on Apple?

Some media also speculated that the CCP has started to crack down on Apple by limiting Apple's usage in bureaucratic institutions and state-run companies.

In fact, the CCP has encouraged some bureaucrats to use Huawei, citing concerns over information security. Though there is no evidence that the CCP intends to expand this limitation into a state-wide ban.

Even though a number of bureaucrats are required to use Huawei , these individuals often carry two phones - Huawei for work, Apple for personal life

From an economic perspective , Apple has already created around 5 million jobs within China. Given the challenges Apple is facing in regions like the EU and the US, this is an opportune time for the CCP to foster a strategic relationship with Apple.

While there may be many unforeseeable factors, such as extreme economic fluctuations, geopolitical relations, or irrational nationalism, it's too early to broadcast definitively pessimistic views on Apple's operations in China.

At the very least, it would be wise to reserve any decisive opinions until after the debut of Vision Pro and the new iPhone.

Keep calm and stay tuned.