A few things on my radar #29

Milk Shift: Who’s Winning? >> Yili (伊利), New Hope Diary (新希望) and BeFood(必如)

👏🙋 Hello, hello! Thanks for reading The Momentum — an independent publication without ads or affiliate links. Feel free to subscribe to receive new posts and support my work!

The notorious melamine scandal severely damaged China’s dairy industry in the short term, but it did not fundamentally alter the industry’s trajectory of being pushed onto an “accelerated” path.

Under the top-down government narrative of “improving national nutrition” and “matching developed countries’ per-capita milk consumption,” upstream farms and processing capacity expanded rapidly. Massive imports of dairy cows, densely established farms, and raw milk production surged to high levels in a very short period—while actual consumer demand lagged behind expectations — the industry experienced explosive production growth starting in 2020, and in less than four years, began to decline in 2024.

The reasons are likely multi-layered: the total population has peaked, births and student populations continue to decline; lactose intolerance remains common; and in traditional dietary patterns, milk has never been a must-have on the table. The result is clear — this is an industry that theoretically “still looks like it has huge potential,” but in reality has entered a cycle of oversupply, destocking, and falling margins.

However, within this overall downward trajectory, different forces are still reorganizing value. Below I want to show readers three Chinese dairy brands I pay special attention to and somewhat admire, and how each is finding its own way to survive and grow against the headwinds 👇.

伊利 (Yili)

A Slowed Giant and a Belated Turn 😭(Yili; Yicai)

Pressured growth: In the first three quarters of 2025, Yili reported total operating revenue of RMB 90.56 billion, a year-on-year increase of only 1.7%, while net profit attributable to the parent was RMB 10.43 billion, down 4.1% year-on-year. ( In 2024, the company achieved total operating revenue of 115.78 billion yuan, down 8.24% year-over-year; net profit attributable to shareholders was 8.453 billion yuan, down 18.94% year-over-year)

Core engine malfunctioning: The drag on the whole was its cornerstone business: UHT milk(Yili holds ~38% share; together with Mengniu, the duopoly controls over 70% of the market.) That segment’s revenue in the first three quarters was RMB 54.94 billion, down 4.5% year-on-year. By contrast, its infant formula and cheese businesses kept growing but are not yet large enough to offset the main channel’s decline.

Slow pace of transformation: Although the chilled fresh milk market is growing rapidly, Yili’s financial reports have never separately disclosed fresh milk sales, and the extension of its marquee ambient UHT brand “Jindian” into fresh milk has not made a big market splash.

Yili’s earnings report reads like a typical “giant turning” health check.

When the industry’s prevailing current shifts from the wide UHT (ambient) sea toward the fresh milk lane that requires cold-chain protection, this giant ship feels unprecedented resistance. Its 4.5% decline in core business is not a random quarterly blip but a snapshot of an era: the nationwide distribution network and large-scale standardized production that once delivered success are becoming liabilities in the face of consumer demand for freshness, short shelf life, and ready-to-drink formats.

The problem is not that Yili hasn’t seen the trend — it began investing in fresh milk years ago. The problem is that the transformation speed of its massive system has fallen out of sync with the pace of consumer change. A sharper contrast is that Yili has only recently significantly increased investment in ready-to-drink dairy drinks, even as ready-to-drink tea has already become a brutal red ocean. Such slowness might have been masked by scale in an up-cycle, but in a down-cycle of static demand it translates directly into painful share loss to competitors.

Perhaps an outbound story must become Yili’s second narrative. Leveraging its mature domestic supply chain and cost advantages to explore Southeast Asia, the Middle East, and other incremental markets is logically sound. But dairy is highly localized: brand recognition, taste habits, and channel barriers make it a long-term undertaking. Yili’s public globalization data remain fuzzy — whether this giant can regain speed in unfamiliar waters is still uncertain.

Its dilemma reveals a harsh truth: in a period of industry paradigm shift, the greatest risk often stems from the path dependence forged by past success.

New Hope Dairy

The Actuary of High-Value Categories 📈(New Hope Diary)

Outstanding profit elasticity: In the first three quarters of 2025, the company’s revenue was RMB 8.434 billion, up 3.49% year-on-year; net profit attributable to the parent was RMB 623 million, up a substantial 31.48% year-on-year. Profit growth far outpaced revenue growth — the best proof of strategic quality.

National expansion:

Centered on the "24-hour" series and the "Asahi" brand emphasizing quality and freshness expanding into the premium national market.

Localized market penetration: Replicating the success of regional brands like "Liangshan Snow" (which holds 75% market share in Xichang, Sichuan), cultivating low-tier markets.

New model: Through a “city-factory + regional cold chain + multi-new-channels ” model, it has built an extremely efficient network of localized fresh milk supply that is hard for national brands to replicate.

If Yili’s report reflects the “pain” of transformation, New Hope Dairy’s report precisely exemplifies the “joy” of focus.

While the industry sinks into price wars, destocking, and margin erosion, its 31.48% net profit growth is like a sharp flash illuminating a completely different path: abandon the obsession with “volume,” and instead pursue “quality” and “price” deeply.

New Hope’s impressive growth shows the foresight of its strategy; fundamentally it is a precise “value segmentation” operation. It did not try to educate the whole country to drink more milk; it decisively bet on a high-value consumer segment that is insensitive to price but highly sensitive to quality and freshness.

However, this brand also faces a risk worth noting: succession.

The future leader is Liu Chang, daughter of founder Liu Yonghao—a female entrepreneur as accomplished and principled as Zong Fuli. While New Hope Dairy’s succession looks more stable than Wahaha’s, appearances can deceive. It’s hard to see what’s really happening inside. The real test will come when Liu Yonghao fully steps back: can Liu Chang establish unquestioned strategic authority and control over resources within the group’s complex industrial empire and its entrenched network of veteran executives?

I hope Liu Chang won’t repeat Zong Fuli’s tragedy.

BeFood (必如)

The “Niche King” That Defines Standards 👑

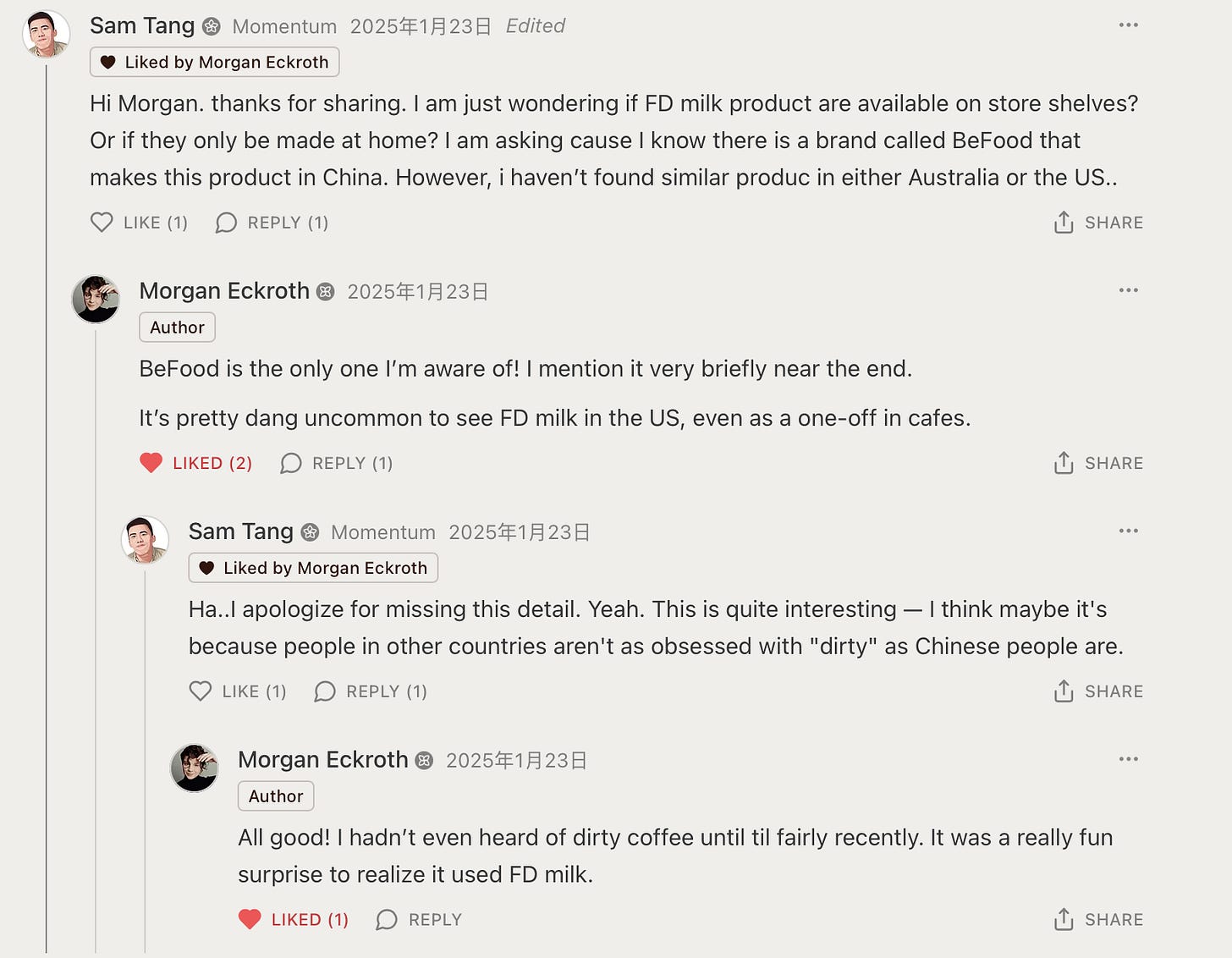

An unlisted invisible champion: As a private company, BeFood does not disclose financials. Its influence can’t be measured by traditional reports but shows up in another dimension — category-defining power.

Creating and owning a category: Its core product, Eisbock 冰博客 (a concentrated milk produced through freeze-distillation), intensifies milk flavor through industrial processing and has become inseparable from “Dirty,” the breakout drink in China’s specialty coffee scene.

Securing B2B formula entry: In B2B markets, it has made “Dirty = BeFood = Eisbock” the default formula. It doesn’t advertise directly to consumers but controls consumption choices indirectly by shaping thousands of coffeeshops’ product standards.

So who is Dirty? 👇

A coffee drink built around a hot espresso shot crashing into ice‑cold milk, designed to create a strong temperature and texture contrast;

The recipe originated from a Japanese specialty café, but it was in China that Dirty became a true menu staple;

Today, Dirty is a near‑mandatory SKU in most specialty coffee shops in China.

BeFood’s case is the most strategically instructive beyond financial statements. It proves that in an industry perceived as struggled and consolidated, there remains a disruptive opportunity to “create a new game and set the rules.”

The brand smart moves was not to improve old products or chase popular new categories like fresh milk. It did something more radical: based on a uniquely Chinese growth scene (the booming specialty coffee culture), it deliberately created an industrial raw material tailored to that scene — a previously unseen standardized ingredient.

The strategy’s power is seismic.

It sidestepped head-to-head battles with giants over channels and consumer advertising, and instead went upstream to capture the key position of “formula.” When a new coffee shop opens and wants to make a market-recognized Dirty, using Eisbock becomes an almost unquestioned industry norm. That means BeFood’s moat is not brand loyalty but the product’s standardness and indispensability. It may never have Yili’s tens-of-billions revenue, but in its narrow and deep niche it enjoys near-monopoly pricing power and an unassailable position.

This reveals the ultimate survival philosophy in an over-competitive market: rather than fighting to be the biggest fish in a red ocean, find your blue ocean and become the undisputed shark.

If you want to make Eisbock at home, read the article by the American coffee champion — Morgan Eckroth — in both her piece and my commentary, you’ll see our shared appreciation for the BeFood brand 👇

Summary > Three Paths, One Future — The War for Value Depth

These three markedly different “report cards” together map the clear migration of value pools in China’s dairy industry:

Yili represents the old-continent guardian: it holds the largest terrain (channels and share), but the soil underfoot (ambient milk demand) is sinking; reclaiming new land (fresh milk, overseas markets) requires time and huge resolve.

New Hope Dairy represents the new-continent boutique farmer: it voluntarily abandons barren land and chooses the most fertile soil (high-tier cities, chilled categories), cultivating intensively to reap rich returns (margins).

BeFood represents the new-continent “pick-maker” or toolmaker: it doesn’t farm land or fight for territory; instead it discovers a new gold rush (specialty coffee) . Its success lies in capturing derived demand.

The core of this battle has shifted from “who has broader channels and louder voice” to “whose value anchors are deeper and more indispensable.” Whether it’s New Hope binding to freshness and scene, or BeFood binding to formula and standards, both deepen the link between their offerings and real consumer needs.

The industry’s endgame may no longer be unchecked expansion by a single giant, but a new ecosystem of “mega players plus many invisible champions” coexisting. Yili-like firms may continue to hold the basic market and mass traffic, while New Hope, BeFood and others will carve out profit-rich, defensible fiefdoms in specific niches.

For consumers, this is arguably the best era — we are no longer being lectured to “drink a kilo of milk every day,” but are served as individuals with more precise and innovative offerings.

To learn more about China's milk industry, you can check out this article I wrote two years ago 👇

Fascinating breakdown of how value migration works in practice. The BeFood case is particularly clever since they basicaly created derived demand by becoming the standardized ingredient for a whole category. That indirect capture of pricing power through formula ownership is something most consumer brands completley miss when they obsess over direct brand building.