A few things on my radar #27

The Second Curve >> Atour, Sexy Tea (ChaYan) and Nongfu Spring

👏🙋 Hello, hello! Thanks for reading The Momentum — an independent publication without ads or affiliate links. Feel free to subscribe to receive new posts and support my work!

In an economic environment marked by slowing growth and intensifying competition, waiting until the first curve peaks to consider change is often too late. Charles Handy’s “Second Curve” theory emphasizes that companies must courageously forge new growth paths before their primary business reaches its zenith. This post explores how three Chinese consumer brands have proactively practiced this principle, successfully leaping to their new growth curve while their core businesses remained strong, thereby achieving resilient growth 👇👇

Atour — Turning Hotel Stays into a Lifestyle Business

According to Atour Group’s Q2 2025 financial results, its retail business accounted for 39.1% of revenue, becoming its second-largest revenue pillar. The revenue of retail segment for the quarter reached ¥965 million RMB, a year-on-year increase of approximately 80%.

The retial business of Atour has been divided our private lables into three product lines—ATOUR PLANET, SAVHE and Z2GO&CO., covering a wide range of products from sleep-related products, personal care to travel necessities.

The success of its “Atour Planet” home products has significantly boosted the growth. To put this in perspective, here’s how Atour Planet stacks up against leading Chinese home textile brands in 2024:

Revenue Comparison: Luolai Home Fashion: ¥4.56 billion; Mercury Home Textiles: ¥4.2 billion; Fuanna: ¥3 billion; Mendale: ¥1.7 billion — [Atour Planet: ¥2.2 billion]

Gross Margin Comparison: Luolai: 48%; Fuanna: 56%; Mercury: 41.4%; Mendale: 40.3% — [Atour Planet: 50.7%], higher than many traditional brands, and even significantly higher than its own hotel management business at 35.9%.

Atour’s model is both powerful and elegant: guests build trust through firsthand experience and then bring that experience home. This goes far beyond cross-selling; it’s a profound form of scenario-based ecosystem building. It successfully transforms one-time accommodation services into a sustained, high-margin revenue stream, embedding the brand more deeply into users’ lives.

The retail business’s gross margin is notably higher than that of the core hotel operations, validating that the second curve brings not only scale growth but also a higher-quality profit model. Atour’s practice reveals a key insight: the most sophisticated second curve often starts by turning your most potent physical space into an immersive, tangible “product catalog.”

Sexy Tea (ChaYan) — When a Tea Brand Grows Beyond Drinks

In 2024, Sexy Tea reported approximately 3 billion RMB in revenue, with a net profit of around 450 million RMB. By the end of 2024, the total number of stores under the “Sexy Tea brand portfolio” — had surpassed 1,000. Within this total, the flagship brand “Sexy Tea” itself operated more than 780 stores (as of November 2025), all of which adhere to a directly-operated model.

In 2024, its retail sales, including snacks and merchandise, surpasssed ¥100 million, a 12-fold year-on-year increase, accounting for 30% of total revenue.

The brand has initiated its overseas expansion by launching snack products on North American e-commerce platforms, a strategic choice that leverages a retail model better suited to its current capabilities than the complex logistics of its innovative beverage line.

Notably, it is highly likely that Sexy Tea is now already the world’s largest fully direct-operated freshly-made tea beverage brand.

While competitors expanded aggressively, Sexy Tea’s deep focus on its home city of Changsha was often mistaken for conservatism. In reality, it was conducting a masterclass in stealth innovation within its stronghold — when milk tea store growth hit a bottleneck and faced fierce competition, it didn’t choose to follow the crowd and frantically open stores like most other brands, but instead focused on direct-operated model and invest harshly on its core regional users and core products to create more complex and novel cross-category tea beverages, even unexpectedly entering the retail sector.

It proved two unique ideas: first, a company doesn’t need a nationwide presence – dominating a single city can create a powerful, formidable brand; second, taking product innovation to the extreme builds immunity to copying.

Its global expansion strategy is particularly noteworthy. While other brands burden themselves with heavy assets to open stores overseas, Sexy Tea opted for a light-asset e-commerce model, first selling its proven-successful snacks and cultural-creative products in North America. This move not only tests international waters at minimal cost and counters the proliferation of copycat stores abroad but also cleverly sidesteps the complex supply chain and certification challenges faced by made-to-order tea beverages expanding abroad.

As for Sexy Tea’s IPO plans, I haven’t done extensive research—but the truth is, whether it goes public or not, its status in the tea drink world remains unshaken. It is, in many ways, the creative epicenter of China’s tea beverage scene. Even Chagee, which has gained significant attention on the global stage, can be seen as a simplified, standardized iteration of Sexy Tea’s original vision.

Nongfu Spring — How the “Worst-Tasting Drink” Became a Billion-Dollar Business

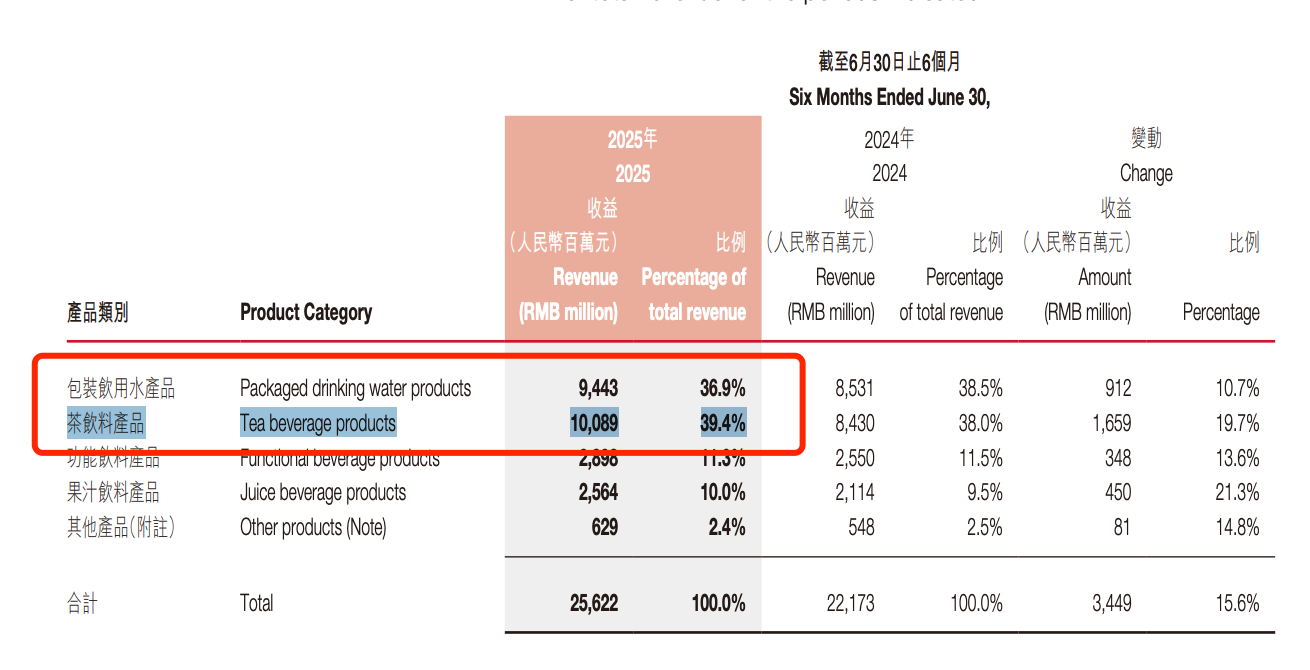

In the first half of 2025, Nongfu Spring reported a total revenue of over 25.6 billion RMB, representing a 15.6% year-on-year growth. Notably, revenue from its tea beverage segment surpassed 10 billion RMB, overtaking its traditional packaged water business to become the largest revenue contributor, with growth approaching 20%.

Its once-criticized sugar-free tea, “Oriental Leaves,” now commands a 75% share of China’s sugar-free tea market. Founder Zhong Shanshan revealed that this business segment was unprofitable for its first six years.

Nongfu Spring’s success reflects a rigorous new-category expansion strategy. It identified the health trend early, patiently invested in consumer education and R&D, and leveraged its distribution network to scale at the critical moment. In a market obsessed with quick wins, it proved that sustainable competitive advantage comes from planting seeds long before the harvest.

The journey of “Oriental Leaves” from skepticism to market dominance highlights that finding the second curve requires not only strategic vision but also the financial discipline to withstand market noise – the courage to endure years of strategic losses to secure a future position of market leadership.

In a complex macroeconomic landscape, these Chinese brands have demonstrated remarkable resilience—not merely sustaining operations but achieving profitable growth. Their outperformance stems not from commoditized price competition or undisciplined expansion, but from deepening user monetization and executing strategic plays into logically adjacent, higher-margin segments.

This disciplined approach stands in sharp contrast to peers trapped in mediocre and tedious price war cycles. Their success offers a critical investment thesis: market saturation in China acts not as a barrier, but as a filter for identifying resilient, long-term compounders with durable competitive advantages.

Ultimately, sustainable value creation depends not on counting which curve you’re on, but on a company’s ability to systematically reinvent itself—resilient brands must have the institutional capacity to evolve while preserving their core brand identity and competitive moat.

This was a great read, fascinating biz innovation!