A few things on my radar #13

Xi's meeting, McDonald's and HeyTea

👋 Hello hello! Thanks for reading The Momentum. Subscribe for free to receive new posts and support my work!

Xi’s meeting with top entrepreneurs 🇨🇳

Xi's meeting with China’s top entrepreneurs partially restored global confidence in China’s economy

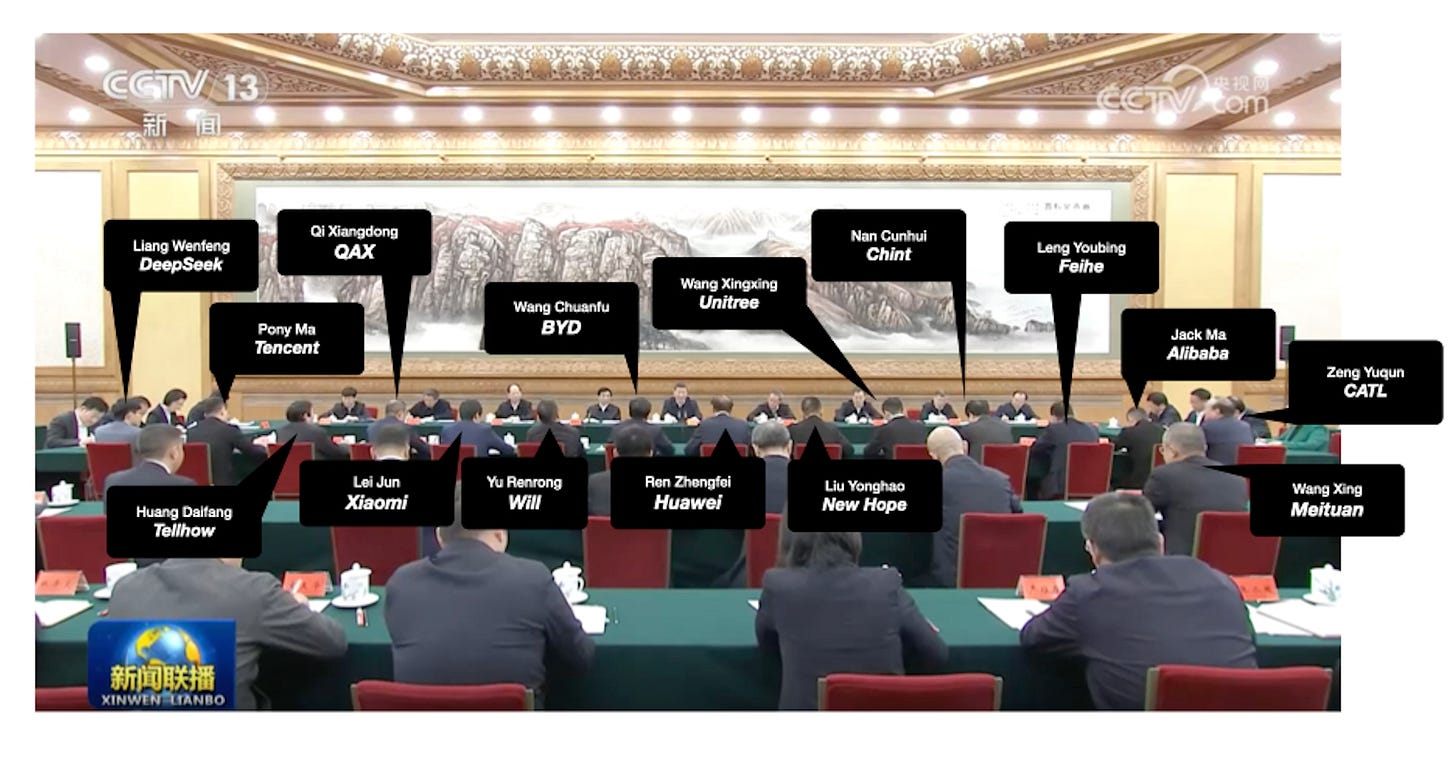

On Feb 17th, Xi met with leading figures from China's technology sector, encouraging them to "show their talent" and express confidence in China's economic model and market potential, Reuters reported.

He highlighted that China's private economy has grown substantially and is well-positioned for high-quality development. Key advantages include strong education and technology sectors, abundant talent, robust infrastructure, and a 1.4-billion-person market.

Xi also mentioned his personal experiences in the meeting: "During my time in Fujian and Zhejiang, I strongly endorsed local private enterprises that focused on their core industries, remained grounded in real business, and steadily grew stronger. These regions had numerous clothing and accessories companies—some of which now lead international trends."

Unlike the 2018 private enterprise symposium which focused on industrial firms, this meeting featured more consumer-oriented companies like Xiaomi, Feihe, and BYD. The shift also highlighted firms specializing in AI and robotics technology, reflecting the state's emphasis on technological innovation, according to Fred Gao, the author of Inside China.

Despite these positive signals and soaring stock prices, many remain skeptical of Xi's initiatives due to persistently weak consumption, ongoing real estate problems, and uncertainty about whether announced policies will be fully implemented.

Now, it’s time to answer the questions I asked regarding the Xi’s rare movement in my last post.

What will next week's meeting be about?

» Revitalize private enterprises.

Xi needs these entrepreneurs, especially during this time of intense U.S.-China competition, since state-owned enterprises are less efficient and struggle to innovate.

» Technology

Currently, competition with the United States is primarily focused on the technology sector — this may explain why many of invited guests represented the technology sector, including Huawei, DeepSeek, BYD, Alibaba, and Tencent. I wouldn't even rule out the possibility that Xi might establish a project like Stagnate to rival their US counterparts.

» Consumption

Xi did not explicitly mention "consumption", but he implied its importance in many details — evidenced by the fact that most companies invited to this meeting were consumer-facing enterprises, along with his references to China's 1.4 billion-person market and his praise for domestic consumer brands that have achieved international success.

Since the technology aspect has been extensively covered by other articles, I want to talk more on consumer market potentials in China.

According to official figures, household consumption makes up only 38% of China's GDP, compared to 60-70% in most developed countries—indicating significant room for growth. Yet, the CCP still has many unused policy tools at its disposal to boost consumption.

Even without considering the consumption growth potential, AI alone can transform the entire consumer industry value chain. Beyond the commonly discussed improvements to supply chain efficiency, commerce infrastructure, and consumer-facing tech products, AI will restructure the consumer sector by fundamentally changing how people, places, and products interact with each other.

Notably, if you're an investor watching the Chinese market, you shouldn't overlook one thing: an consumer brand called Monster known primarily for its energy drinks created a legendary story of thousand-fold growth on the US stock market over several decades. While China has its own Amazon and Google, but where is China's Monster?

What roles will Jack Ma, Liang, and private enterprises play in China's economic and political landscape going forward? Will private entrepreneurs receive greater support, autonomy, and even political voice? Or will they simply become puppets of the CCP?

Given the CCP's need for private entrepreneurs to tackle key challenges, these long-neglected entrepreneurs will be granted some autonomy that even extends beyond just today's prominent players to include a broader spectrum of businesses.

The CCP is now actively seeking to discover the next innovative entrepreneur by promoting innovation and entrepreneurship across the nation. Many local governments are adopting Hangzhou's approach, where officials function more like venture capital investors—providing funding and support rather than exerting strict control—giving entrepreneurs and innovators more space to run the game. Yet, it may take some time, as many bureaucratic local governments find it difficult to adapt to this new mindset.

However, as for whether entrepreneurs will gain more political influence - Put simply, if you're wondering whether entrepreneurs might openly challenge government policies head-to-head, spread their own political ideas while attracting a large following of devotees like Jack Ma did before, that’s almost impossible now. Obviously, they will function more like military commanders on a battlefield—they may have some operational freedom, but their efforts are ultimately aligned with national objectives.

McDonald's

McDonald’s launches “CFC — Cage Free Chicken” campaign provoking KFC’s main course in China

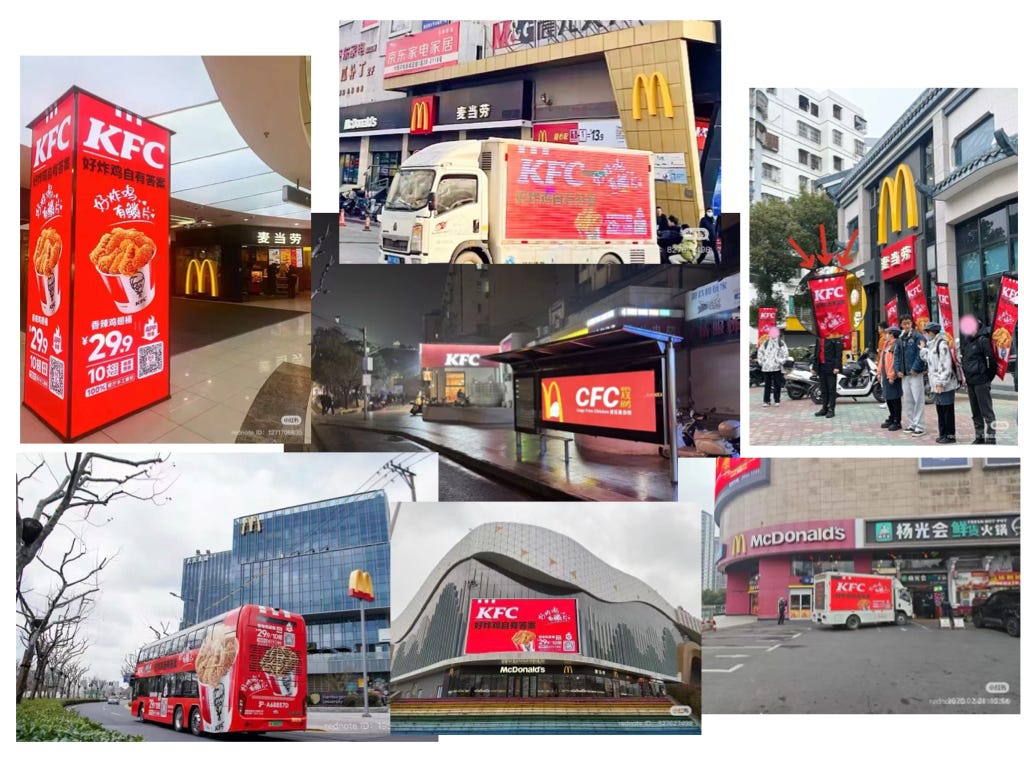

McDonald's launched a "CFC" (Cage Free Chicken/无笼好鸡) campaign, some ad posters are just near KFC locations in China. The campaign featured a white chicken mascot and had been in promotion since February 15th.

McDonald's said they have been committed to using cage-free white-feathered chickens in China for over 30 years. These Cage-Free Chickens (CFC) can move, eat, and rest freely in more spacious areas instead of being confined to small cages. This farming method not only improves animal welfare but also helps enhance the quality of chicken meat.

In response, KFC doubled down on advertising spending to counter McDonald's, emphasizing its 'K' branding and showcased its handcrafted chicken preparation process that creates their chicken with signature crispy coating, positioning it as the mark of authentic fried chicken.

If you're familiar with the Chinese market, you should know that KFC is much stronger than McDonald's in China. That’s why - I heard KFC's team was furious and mobilized resources overnight to launch a comprehensive counter-advertising campaign across all channels to assert their dominance in fried chicken.

Come to think of it, it's interesting - It's rare to see two leading consumer brands in China go head-to-head like this. In fact, McDonald's and KFC have coexisted peacefully for so many years, this sudden aggressive approach triggered by McDonald's feels a bit unusual — McDonald's seems unsatisfied with the status quo, their ambitions have grown in China.

From a marketing perspective, McDonald's (the eternal industry runner-up) made a brilliant move by challenging KFC's (the perpetual industry leader) flagship product with their non-core offering - it's a guaranteed win. The math is simple—McDonald's didn't spend much money, but every dollar that KFC, who has deep pockets, spends responding increases awareness of McDonald's fried chicken. Of course, KFC's aggressive push-back is also quite understandable. It serves not only to protect their status but also to send a clear warning: "Try this again, and we'll drown you in advertising until you can't breathe."

Looking at the ad content more broadly, this competition over ingredients and cooking techniques reflects a growing trend - brands recognize that Chinese customers now value food quality more than just price. Being transparent about supply chains and sharing kitchen stories has become an effective way to engage consumers and build trust.

I'm curious to see how this unprecedented "fried chicken war" in Chinese restaurant history will end — but honestly, who cares? After all this marketing, I'm craving fried chicken and plan to try both. 🍗🍗.

HeyTea

HeyTea, a Chinese milk tea chain, has begun strategic contraction in the domestic market due to intense competition

HeyTea issued an internal letter rejecting price wars and seeking differentiation last year. This opposed "involution" (内卷) - pointless competitive escalation. Recently, HeyTea reinforced this stance by halting franchising.

HeyTea noted that the industry faces oversaturation and inefficiency due to excessive store expansion driven by growth targets rather than customer needs. Going forward, they will prioritize enhancing store experience and brand value while supporting existing partners.

Many consumers have reported that HeyTea franchise stores provide poor experiences — cut corners on ingredients, have terrible service attitudes, and even offer far fewer product varieties compared to company-owned stores.

Despite its domestic restraint, HeyTea continues its international growth. On Feb 22nd, HeyTea opened their first overseas “Tea Lab” in New York's Times Square.

The company now operates over 4,000 stores, with more than 70 locations overseas.

The last time I heard someone in China refusing to engage in a price war was Starbucks, but before long, they were still forced by competitive pressure into such battle until today.

HeyTea faces similar challenges to Starbucks—even in a growing category, their product competitiveness is under threat from intensive rivals, but neither wants to erode their brand image through constant price cuts. However, this is not up to them — if product competitiveness cannot be maintained at the leading edge, price cuts will be inevitable.

IMO, the deeper issue here is that most Chinese new-born brands haven't reached the stage where they can truly talk about their brand value too much - without getting the product right, any hard-earned reputation will be quickly destroyed - but many mistakenly believe they have a strong value when all they really have is name recognition at the moment.

Needless to say, for many VC-backed Chinese consumer brands who are hitting growth bottlenecks domestically while having already established a certain market scale foundation, overseas expansion has become a necessity — they can leverage their domestic supply chain advantages to expand internationally to offset some of the domestic struggling.

But, this doesn't mean the domestic market has no room for growth - In fact, quite the opposite - the domestic market is vast, but whether rapid growth can be achieved depends on many variables. Let’s face it — when you enter an unfamiliar region with an mediocre product and happen to encounter a group of strong local competitors, of course you won't be able to grow easily 🙂

// Want to know more stories about beverage wars in the Chinese market? Read this: Beyond earnings — What's behind Starbucks' decline in China? And check out: Will Costa dethrone Nestle in the ready-to-drink coffee segment in China?

Thanks for reading! Feel free to leave your comment. If you found this valuable, please subscribe or share it with someone who might be interested.

Honestly, it's been a while since I've written any in-depth analysis articles, I'll likely publish something soon — stay tuned.