Will Costa dethrone Nestle in the ready-to-drink coffee segment in China?

Costa, which failed to compete in the coffee shop industry in China, is attempting a comeback by exploring other coffee drinking scenarios.

Article Highlights

Costa ambitiously entered the Chinese market a decade ago but recently suffered a setback due to a lack of brand experience, especially in-store operational capabilities.

After being acquired by Coca-Cola, it decisively abandoned its store expansion strategy and shifted to the ready-to-drink coffee market, achieving promising results.

The potential of the ready-to-drink coffee market in China is massive. While it presents a transformative opportunity for Costa, it also paves the way for expanded possibilities for other beverage and coffee enterprises.

Costa starts with a flop

Costa Coffee entered the Chinese market in 2006, a full seven years after Starbucks. By early 2011, Starbucks had already established more than 400 stores and had plans to reach 1,500 stores by 2015.

Costa, branding itself as the genuine coffee experience, strategically placed its outlets near Starbucks stores while maintaining comparable coffee pricing. Although Costa had only 100 stores in 2011, they set an ambitious goal: to capture at least one-third of China's coffee market by outpacing Starbucks in store openings and having 2,500 stores by 2018.

However, the situation did not unfold as Costa expected.

Upon entering China, Starbucks wisely formed franchising partnerships with experienced entities in the food and beverage industry, while Costa chose to align with two partners primarily focused on real estate.

As a result, Starbucks has implemented a highly standardized service process, including the way the order is taken, the markings on the cups, and the process of serving the coffee.

However, even though Costa advertises itself as authentic coffee, their service process fails to achieve even the basic experience due to the lack of local catering experience on their part and that of their partners.

"I can't feel any positive vibes for Costa," a user on Zhihu complained about the Costa store experience. "Each store serves latte differently with or without syrup, the staff doesn't care about customers cutting in line, they don't greet customers properly, and they often give an attitude. The card payment devices frequently malfunction, and purchased vouchers often mysteriously fail to work."

Ultimately, although Costa always managed to find store locations close to Starbucks, the in-store experience was far from comparable to Starbucks, which led users to consider it only as a backup choice to Starbucks.

By 2018, Costa had fewer than 500 stores, approximately 12% of Starbucks' store count at the same time, falling far short of its initial goal of 2,500 stores.

The coffee shop industry's relentless growth left Costa no breathing space. Even amidst the pandemic, while chain stores like Starbucks, Tim Hortons, Luckin, and Manner were swiftly expanding, Costa had to grapple with the tough decision of closing down 10% of their storefronts.

Adding to the challenge was the rising trend in specialty coffee culture, which led to the emergence of local independent coffee shops and the participation of international specialty coffee chain brands. These coffee shops generally have high standards for coffee quality and offer a more diverse range of styles, creating a competitive landscape where Costa's claim of authentic quality coffee is no longer a differentiating factor or an advantage.

Fast forwarding to today’s coffee landscape, and it is still hard to imagine Costa surpassing Starbucks in China. Costa isn’t even the standard second choice after Starbucks anymore, as Chinese consumers now have too many better options.

Clearly, if Costa doesn't make some decisive changes, it will be difficult for them to survive in the Chinese market.

The Big Pivot

Many fast-moving consumer goods companies have recognized the growth opportunity in the Ready-to-Drink (RTD) coffee segment. This refers to coffee drinks packaged in cans, cups, or bottles, which make it possible to take a favorite coffee drink anywhere conveniently.

Nestlé was the first brand to enter the RTD coffee race in China, successfully leading the way since 1998. Starbucks has collaborated with a strong channel partner Tingyi Holding Corp to explore the market since 2007. In addition to Nestlé and Starbucks, there are also several other brands participating, including Bernachon (贝纳颂 bèi nà sòng), AHA(雅哈 yǎ hā), and Kirin. However, their market share is not significant.

As carbonated drink consumption declines and coffee culture grows, beverage and coffee giants have started to make moves in this field.

Coca-Cola once attempted to introduce their successful RTD coffee brand, Georgia, from Japan, as well as a coffee-flavored cola in the Chinese market. Both of these products were unsuccessful due to not aligning with the taste preferences of Chinese consumers. Georgia was too bitter, while the coffee-flavored cola tasted like unpalatable medicine.

However, Coca-Cola's coffee ambition has not stopped. In 2019, Coca-Cola fully acquired Costa, aiming to leverage Costa's coffee platform capabilities and combine them with Coca-Cola's marketing and channel advantages to explore opportunities in the coffee industry. With this move, Costa shifted its focus away from solely expanding coffee shops and instead aimed to cover more coffee-related scenarios outside traditional stores, especially in the RTD domain, where both brands could maximize their strengths.

China became Costa's first overseas expansion for RTD products. In March 2020, while the market's attention was fixated on the coffee shop war, they quietly entered the market with a 300ml RTD coffee, priced around 1 dollar, matching Nestlé's price category in China, but with a slight increase in volume.

To stand out in the market, Costa focused on differentiating itself through packaging and taste.

The bottle design of Costa is elegantly simple and visually appealing, giving it a strong advantage in visibility compared to their competitors.

Simultaneously, Costa promises to use the same coffee beans in its stores to ensure coffee quality. Through coffee taste experiments in its stores, Costa has introduced a line of RTD coffees with the most popular flavors that Chinese consumers enjoy, including the classic Italian latte, as well as the Coconut Latte (生椰拿铁 shēng yē ná tiě) that has been popularized by the local coffee chain, Luckin Coffee.

"Stores rapidly introduce new products according to different seasons, continuously innovating beverages and food, while preserving core items,” said Han Liang, the head of Costa's RTD business in China, shared with Foodinc, a Chinese media outlet focusing on food and beverages. “However, for ready-to-drink products, scalability is a decisive prerequisite for innovation, so launching new items isn't as agile as it is for our physical stores."

As the market ceased to remain as tranquil as before, Nestlé accelerated its product upgrade efforts. In 2022, they introduced a fresh brand proposition "Remind Every Day" and comprehensively revamped the visual system of Nestlé coffee. They also enlisted a new spokesperson to spearhead their promotional campaign and introduced new flavors one after another.

Meanwhile, Starbucks has also increased investment in its RTD product line to establish a more comprehensive product portfolio and enhance competitiveness as the market has become increasingly lucrative. In 2021, Starbucks introduced the "Starbucks Selected" 270ml RTD product line exclusively for the Chinese market, directly competing with Nestlé and Costa. The following year, they upgraded the packaging of this series, aiming to stand out on the shelves in the face of competition.

"If I were to pick from the shelves, I'd definitely choose Costa. Its vibrant appearance gives me the feeling that it will energize me after drinking," shared an anonymous coffee lover living in Shanghai. "Nestlé feels richer in taste, Starbucks is a bit sweet, while Costa strikes a balance with a milder taste. But the brand I drink the most is Nestle because it's available almost everywhere.”

Nestlé currently dominates the market with over 40% of the market share. In the short term, it is unlikely that Nestlé will lose its top position because the company focuses on instant and RTD products in China more than any other brand. They have full control over the value chain, from production to getting products on shelves, while Costa and Starbucks rely on channel partners to accomplish this task.

Growth Space for Costa

Busy consumers do not have time to wait for each cup of coffee to be prepared in a coffee shop, nor can they drink takeout coffee for every cup. As the pace of life gets faster, the demand for ready-to-drink (RTD) coffee that can be consumed quickly and conveniently will continue to increase. Accordingly, the well-made Costa RTD coffee is expected to consistently grow in response to this increasing demand.

Besides growing naturally, expanding the product lineup is a crucial way to boost the business.

In addition to creating different flavors based on store data, Costa could explore various packaging options. Currently, all Costa products are packaged in containers with a capacity of about 300 milliliters. In the future, companies might consider developing packaging in different sizes and materials to cater to different consumer preferences. For example, Costa could consider options such as small canned coffee products or larger bottles with a capacity of about 750 ml or 1 liter.

With a strong channel network accumulated by Coca-Cola, Costa also has the opportunity to effectively expand its presence across the entire nation.

According to Meituan data from early 2023, the growth rate of coffee orders in third- and fourth-tier cities exceeded that of first- and second-tier cities. Costa products, which have already covered all first- and second-tier cities, could take advantage of changing consumer preferences in low-tier markets with the help of Coca-Cola.

Industry-wide opportunities

Today, the market's flavors of RTD coffee mainly revolve around classic Italian-style and milk tea-infused coffee, while many trendy flavors or brewing methods popular in China have yet to appear on the shelves, such as osmanthus sweet fermented rice latte, Moutai liquor latte, and nitro cold brew coffee.

Furthermore, it is clear that Chinese consumers will increasingly prioritize the natural flavor of coffee beans rather than being solely attracted to external recipes. They will also have higher expectations for the roasting process. As a result, in the upcoming years, RTD coffee will undoubtedly be produced using a diverse selection of regional beans, including native beans from Yunnan Province, and various roasting levels, such as light, medium, and dark.

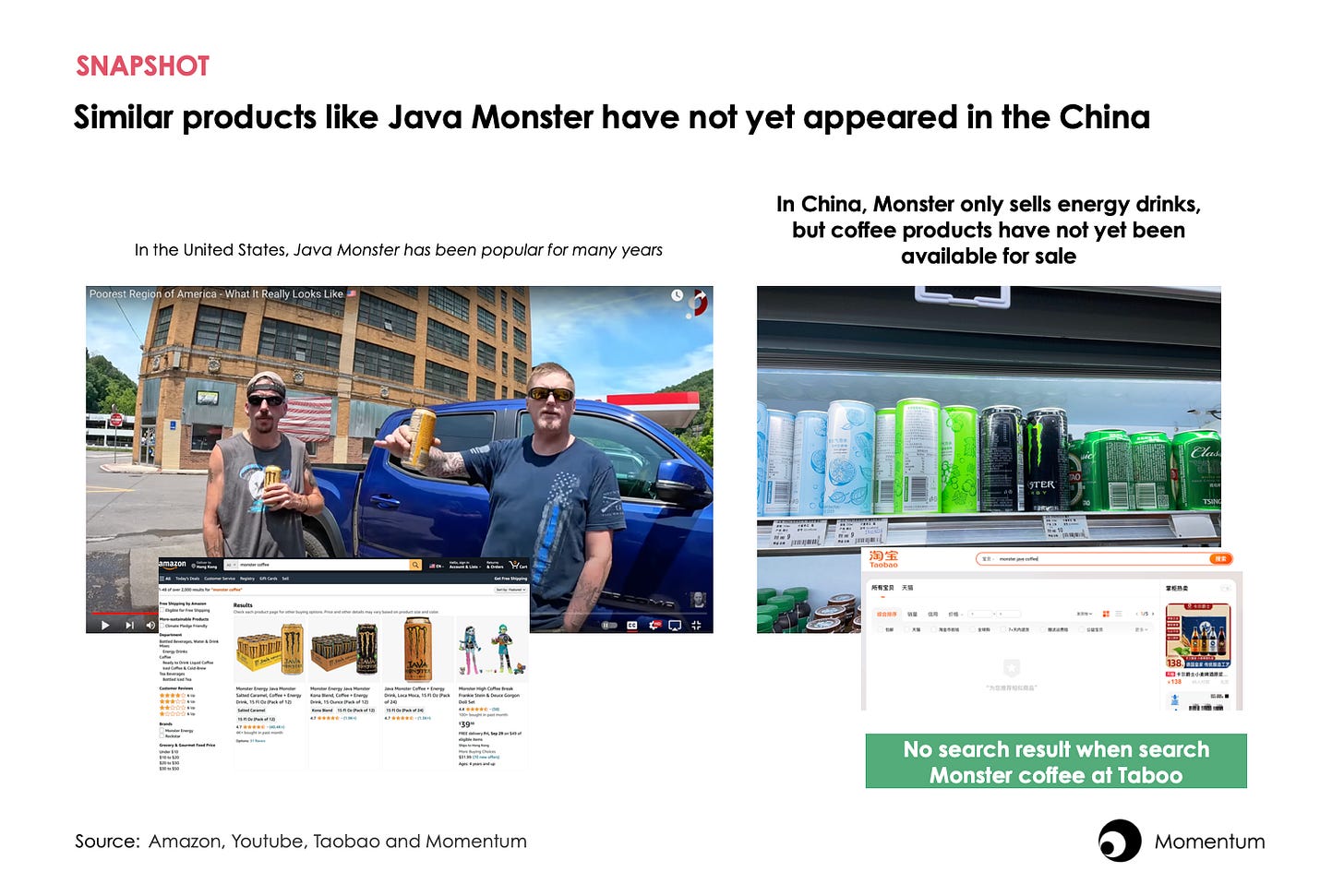

Of course, there are also some innovative overseas RTD products that domestic market operators can learn from.

A prime example of such drinks is Monster's Java series, which distinguished itself from regular RTD coffee by combining caffeine with other energizing ingredients, such as taurine. However, this type of coffee has yet to make an impact in the Chinese market.

With the acceleration of the pace of life among Chinese white-collar workers and the desire for outdoor sports, some brands will eventually explore this untapped market.

Rest assured, the taste buds of Chinese consumers for coffee have been awakened. The variety of RTD coffee available in Chinese stores will soon become much more diverse. We can expect to see a wealth of interesting products and innovations in the foreseeable future.

Of course, in this "coffee war," consumers are the undisputed winners.

The Nestlé coffee at my downstairs convenience store has started offering discounts once more, creating a caffeinated frenzy in the neighborhood! It's time for coffee lovers like me to grab our favorite brews at tempting prices, as the RTD coffee players race for our hearts and wallets.

Comprehensive!