What is driving FREITAG’s market penetration in China?

The recent surge in growth and the compelling brand engagement of Swiss icon FREITAG provide valuable insights into the future landscape of sustainable business in China.

Article Highlights

FREITAG has gradually moved into the Chinese market, via brick and mortar in Shanghai.

In the past few years, engagement with the brand has significantly increased due to shared sustainable values with the domestic market, as well as their focus on cultivating long-term customer lifetime value.

Ultimately, FREITAG's recent growth and brand engagement serve as clues of what’s to come in regard to sustainable business in China.

Penetration into China

As China embraces sustainable consumer goods, how has the Swiss brand FREITAG managed to enter and succeed in this coveted market? The answer lies in a narrative of practicality, vision, and timing.

Founded in 1993 by two Swiss brothers, FREITAG embarked on a mission to champion urban sustainable lifestyles right from the outset, crafting one-of-a-kind bags and accessories from repurposed truck tarps and fully compostable textiles.

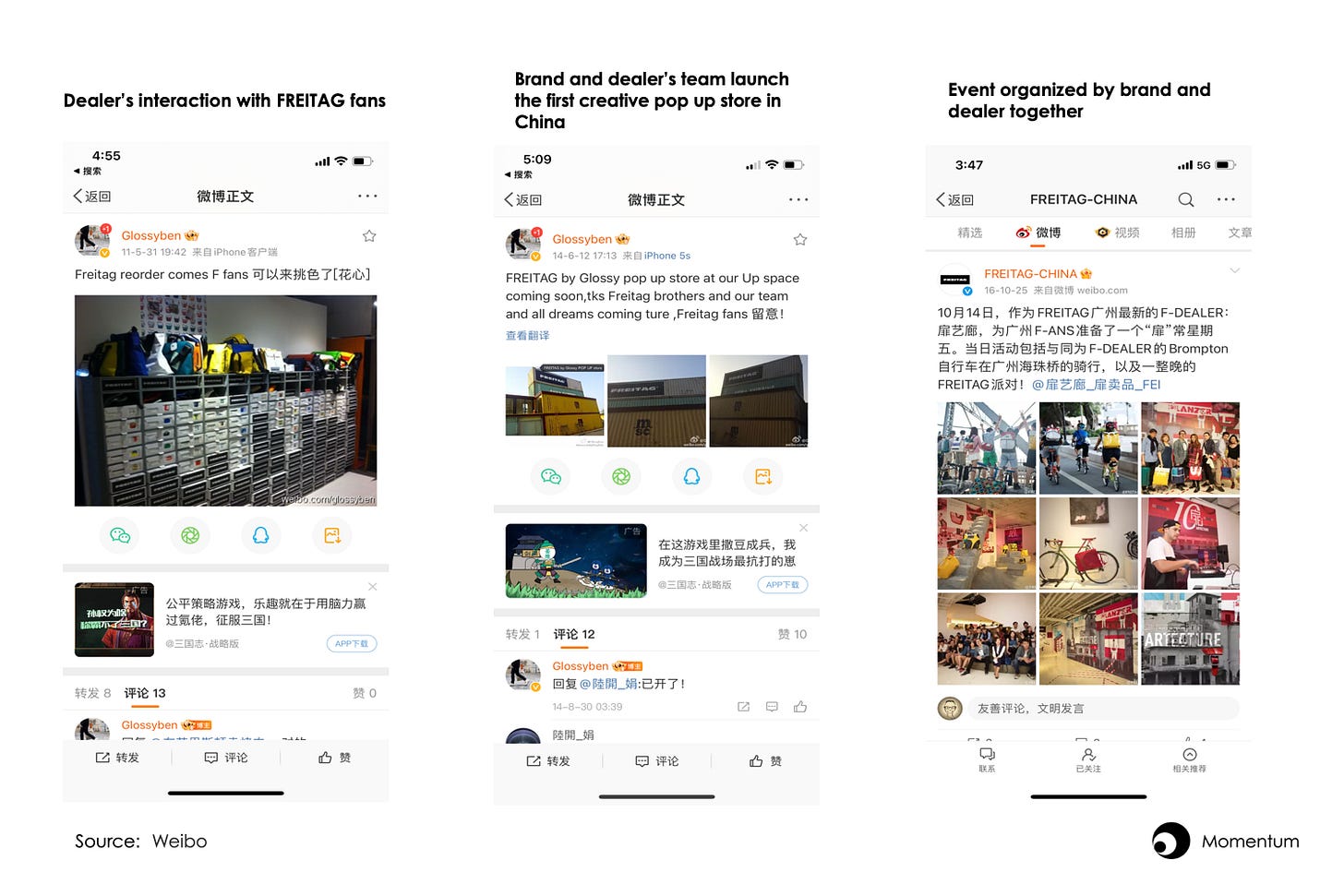

Since 2004, FREITAG has appeared on the shelves of Glossy, a once-popular local fashion boutique in Shanghai, to make their entrance into China.

In the early stages of the market cultivation phase, they artfully captivated consumers through exquisite brick-and-mortar partnerships.

Unlike the rush to conquer through blind store expansions or ad investments, FREITAG chose to forge long-term connections over time with local retailers and niche clientele while concurrently presenting a clean, chic physical experience. This all reinforced FREITAG's brand investment in China, showcasing to audiences its customer centric approach.

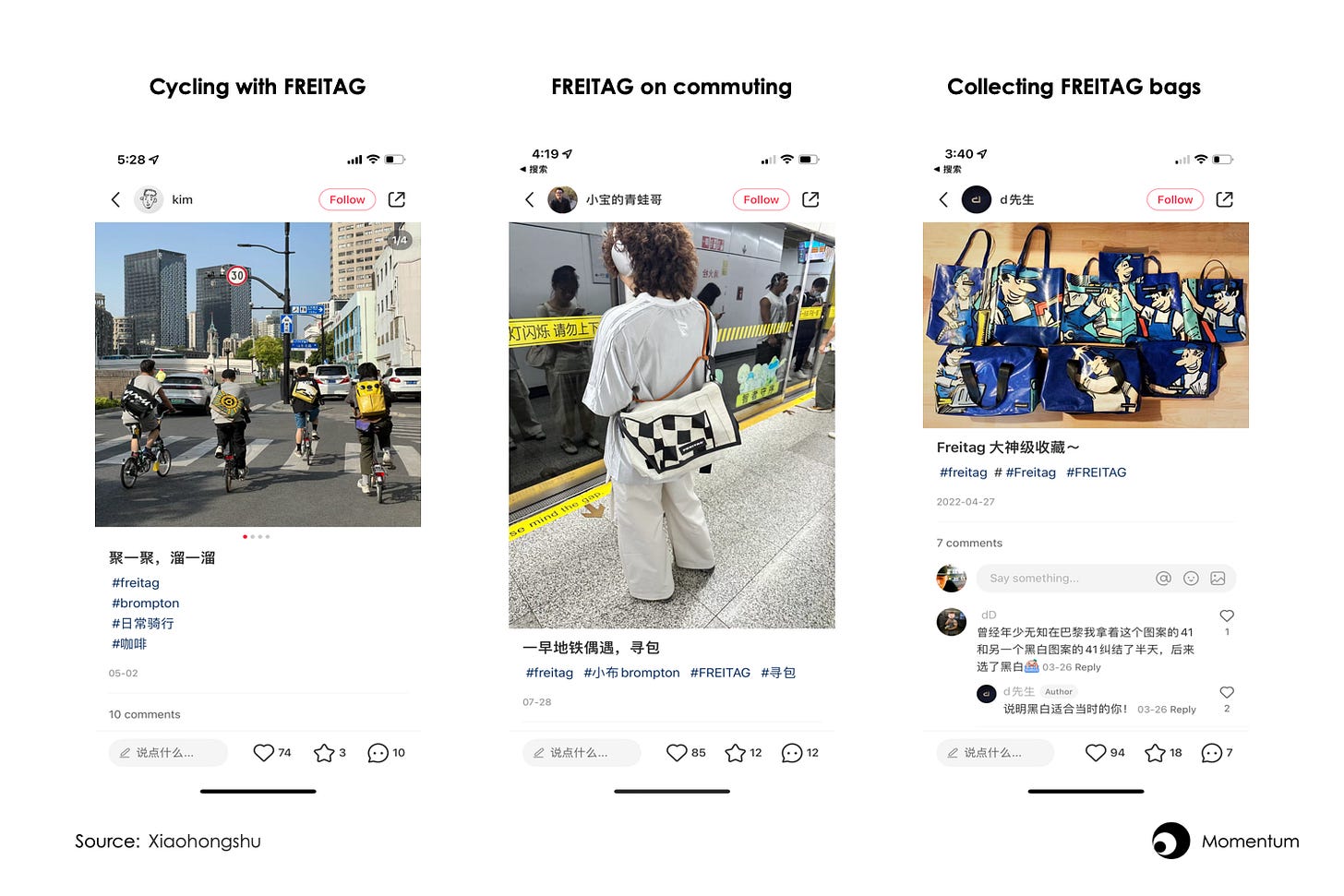

FREITAG’s way of doing business resonated highly with the open-minded designers and artists of China. Eagerly embracing FREITAG's vision and design, these early adopters were not only long-term supporters and purchasers of FREITAG's products, but they were also catalysts of passion, organizing spontaneous gatherings, nurturing brand communities, and even championing the brand's cause pro bono.

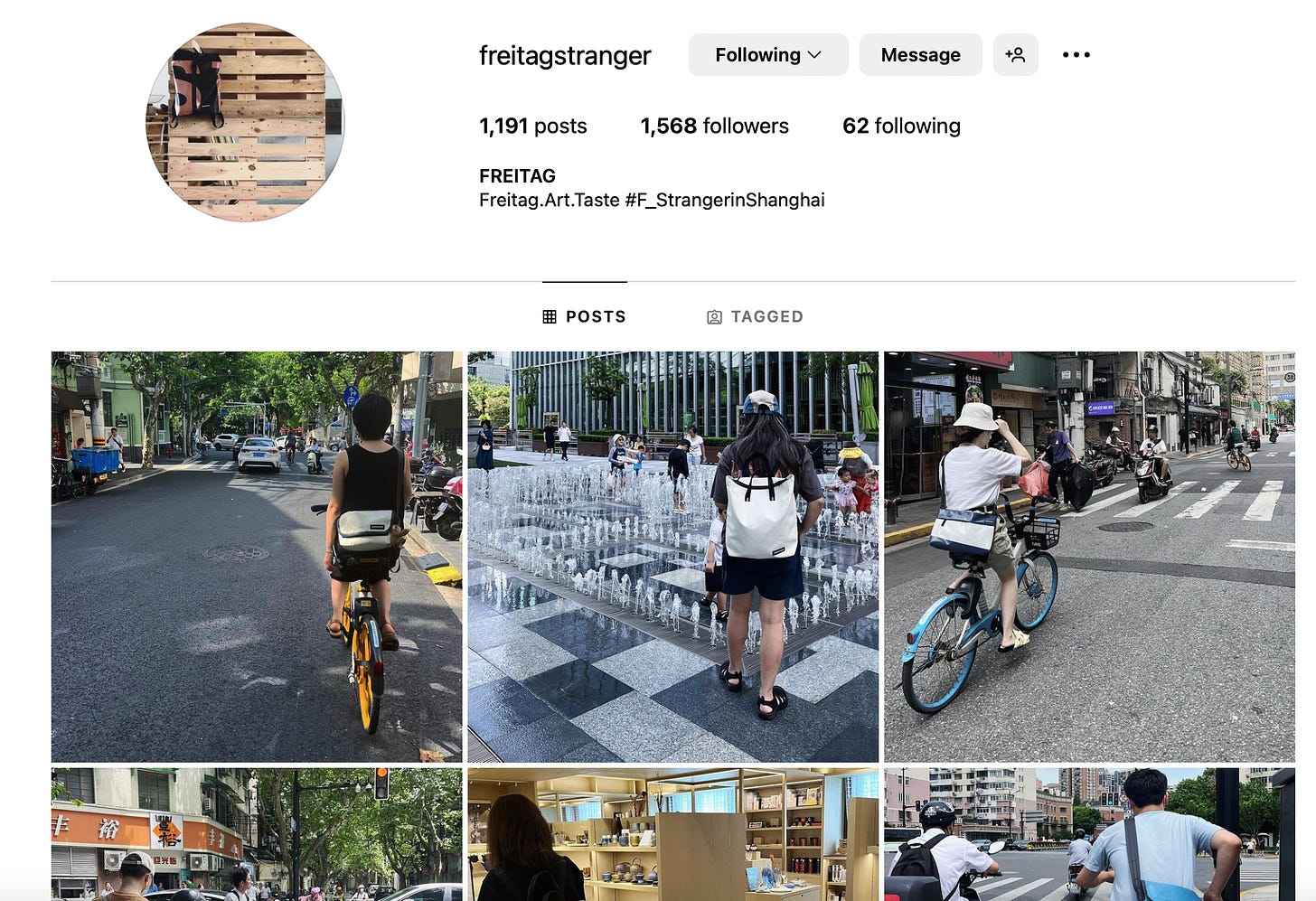

"I can't resist capturing snapshots of strangers flaunting their FREITAG bags, each a canvas of individual style and color," mentioned Darou, a designer from Shanghai who has gained popularity through his voluntary street photography work for FREITAG since 2015."It's been a delightful journey, and I've met countless kindred spirits along the way."

Word-of-mouth became their most powerful advertisement. Through the driving force of loyal fans, FREITAG has gained a significant fan base, which has given them the confidence to invest in flagship stores, an e-commerce platform, and even establish their own logistics system to ensure efficient operations in China.

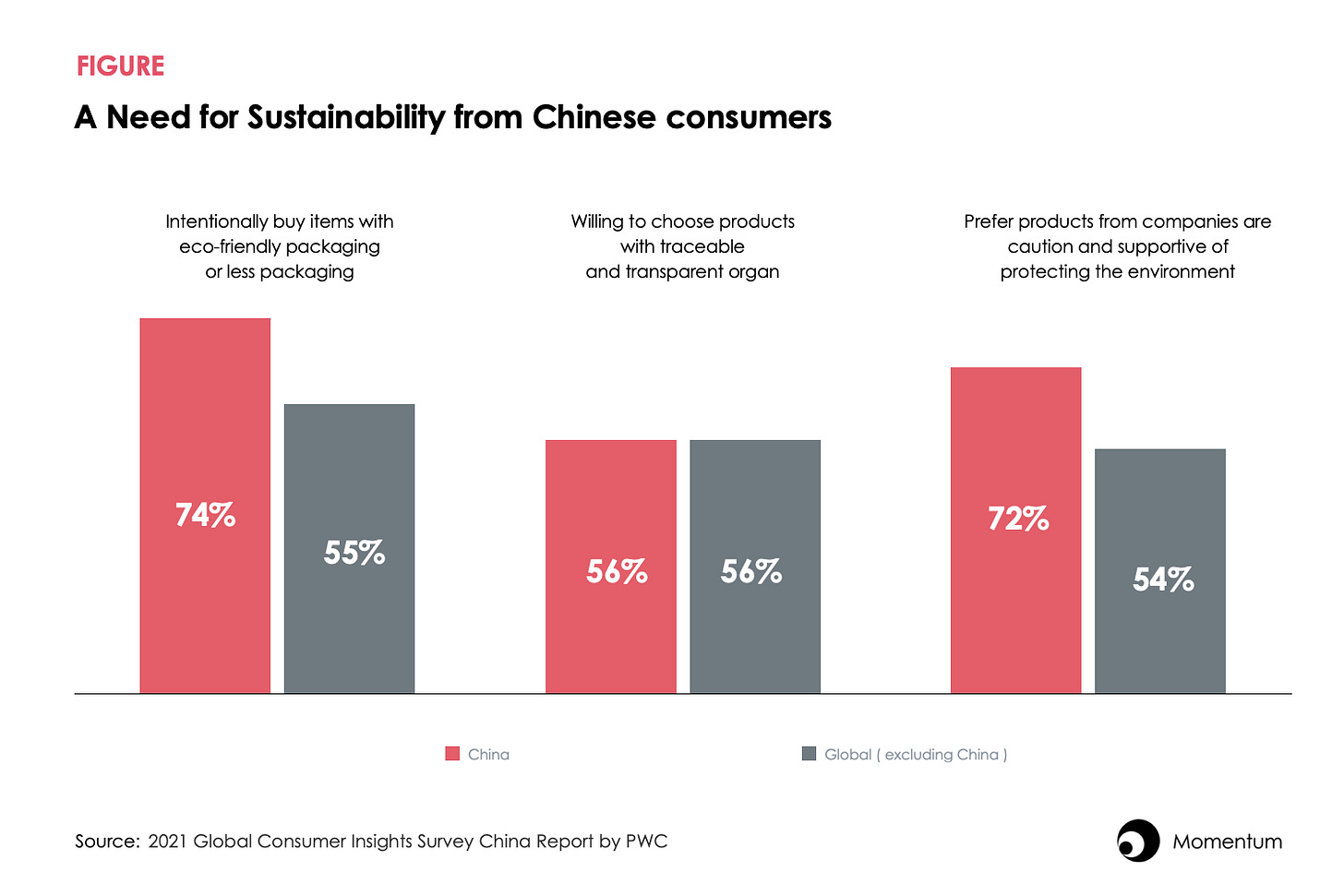

In recent years, China has witnessed a rising tide of sustainable consumption, spurred by government initiatives and a collective push for a greener society. The pandemic-induced anti-materialism trend has further fueled the fire. The desire of Chinese consumers to buy sustainable and environmentally friendly products is growing.

However, the concept of sustainability remains somewhat enigmatic to many, and most Chinese consumers are not sure about what actions they can take, a puzzle begging to be solved—FREITAG stepped in to offer the missing piece.

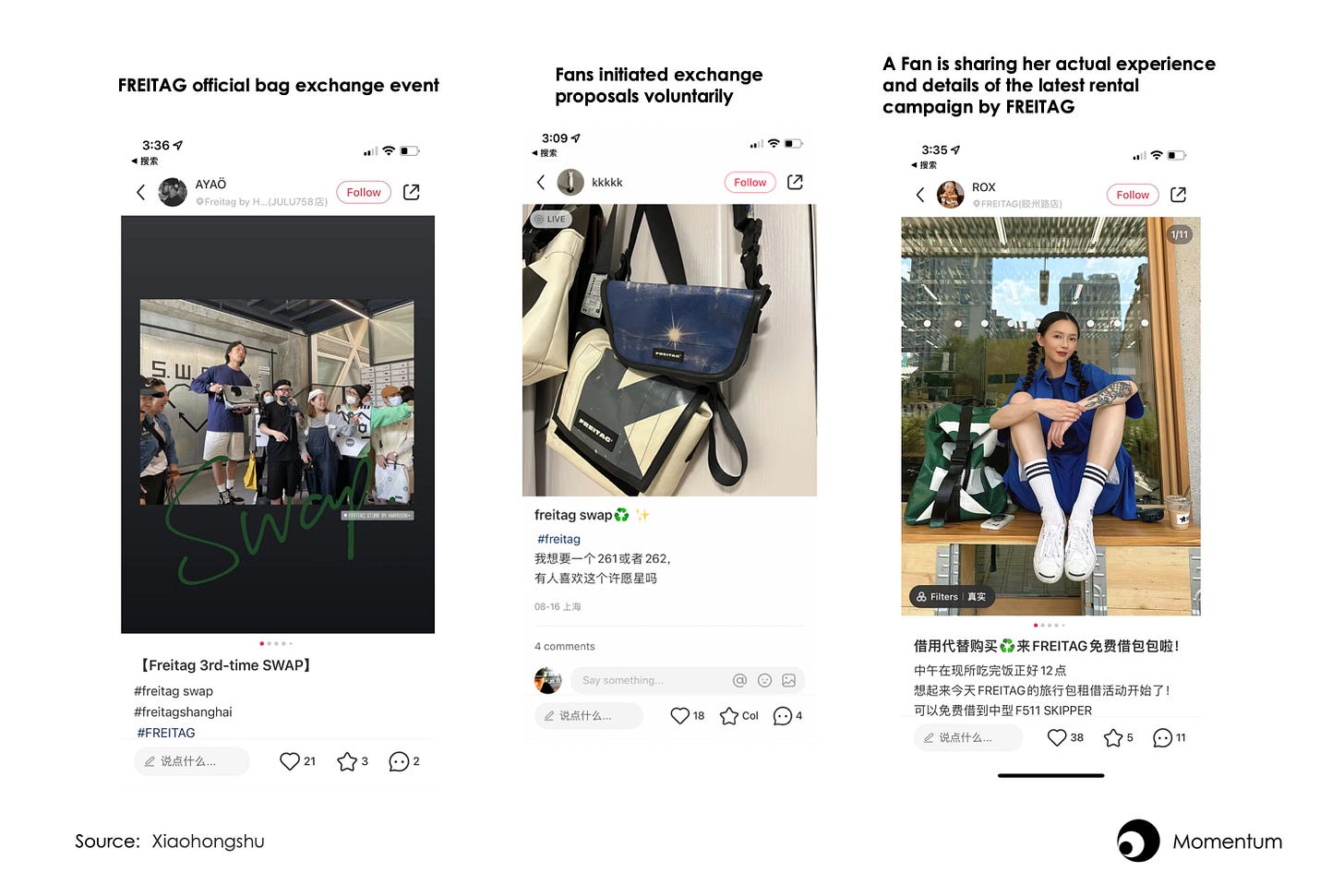

For instance, FREITAG advocated for a circular economy in order to combat overconsumption. Since 2019, they have been urging customers to prioritize usage rights over ownership through initiatives such as leasing and bag exchange campaigns in China. Even during shopping festivals, customers were encouraged to exchange items with each other instead of making more purchases.

These activities play a specific role in sustainable lifestyle education. Many people have fallen in love with FREITAG because of it, including my girlfriend and I.

We invested in a $300 FREITAG bag together, and we bring it with us everywhere, except for formal occasions. It's not as flashy as the Louis Vuitton bag in the cabinet, but it gives us a sense of humility and uniqueness.

"Who would have imagined a brand advocating for buying less?" Xixi, my girlfriend and a barista in Shanghai, remarked. "FREITAG has revealed the absurdity of excessive consumption. It has provided us with new inspiration for life after Covid."

FREITAG clearly showed Chinese consumers that by adopting their practices, it is possible to live a fulfilling life without spending too much. Sustainability is not just a slogan, but it can genuinely enhance the quality of life.

Accordingly, FREITAG has become widely visible, both on the streets and in the office. By 2021, China had become FREITAG's third-largest market, following only Korea and Switzerland. Many loyal fans not only purchase one bag, but also strive to collect additional styles or rare color combinations due to their one-of-a-kind design.

However, when I observe some highly enthusiastic consumers on social media who have purchased a large quantity of FREITAG products aimlessly, I question whether this is consistent with the mission and values of the company.

Fortunately, a comment from internet users has dispelled my doubts. He/She believes that buying a substantial number of FREITAG products is absolutely ethical, as the durability of their materials allows for passing them down to future generations.

I didn't know I bought so many, and I'm still addicted. The brand concept is supposed to be environmentally friendly, but here I am...I can only console myself that I can use them for my children. In the long run, it can be considered environmentally friendly, right?

FREITAG really has to thank this fan for providing a reason for die-hard fans to own more FREITAG's products, while also supporting the company's bottom line.

Learnings from FREITAG's Chinese Odyssey

In the end, FREITAG's foray into China appears at the moment to be a big win-win. What can we gain from observing these recent market trends and how can we utilize these insights?

Tap into the lifetime value of a niche group

The cost of acquiring new users online is becoming more expensive in China, as it has reached the level of offline rent costs.

According to data from 2017 to 2020, customer acquisition costs for JD, Alibaba, Pinduoduo, and Meituan increased significantly from $7 , $6, $0.7, and $5 to $8, $12, $7 and $6 respectively.

An anonymous clothing retail industry professional told me,

In recent years, the costs of online and offline stores are essentially the same, with rent and advertising expenses accounting for 25%-30% of the cost structure. Advertising costs may be slightly lower than rent, but online retail faces a return rate of 60-70%, resulting in similar costs for both online and offline channels.

To avoid being kidnapped by advertisements and real estate developers, it is more reliable for a brand to directly nurture loyal customers who are willing to support the brand in the long run.

This is precisely what FREITAG has accomplished.

They cultivated an enthusiastic but niche group of supporters and consistently offered value - numerous products, information, events and the feeling of being unique to their core customers over time. This gave loyal fans enough incentive to keep purchasing their products and recommending them to like-minded individuals, all without relying on advertisements and excessive store counts.

Similarly, the American yoga brand Lululemon has also implemented this strategy in China.

The brand began establishing local communities in China in 2013 when they first entered the market and have successfully built the largest brand community platform in Asia. While their customer base is not extensive, with the total yoga population in China being 4 million, their fans have strong purchasing power and a high repurchase rate. Despite having a relatively small number of stores (just over 100) in China, their revenue per store, around $7 million, is almost ten times higher than Nike's.

Seizing the early bird advantage

Entering a market early can help you avoid fierce competition and give you the chance to establish influence and competitive barriers.

FREITAG is an excellent example of being ahead of the game. They have been catering to Chinese consumers long before green or sustainability became a priority in society. Now it is them, not those who are still watching, who are enjoying the dividends.

Certainly, FREITAG is not the only brand with a vision. Patagonia, an American outdoor brand well known for its commitment to environmental and social responsibility, entered the Chinese market almost two decades ago through distributors and has had a similar development trajectory to FREITAG in China.

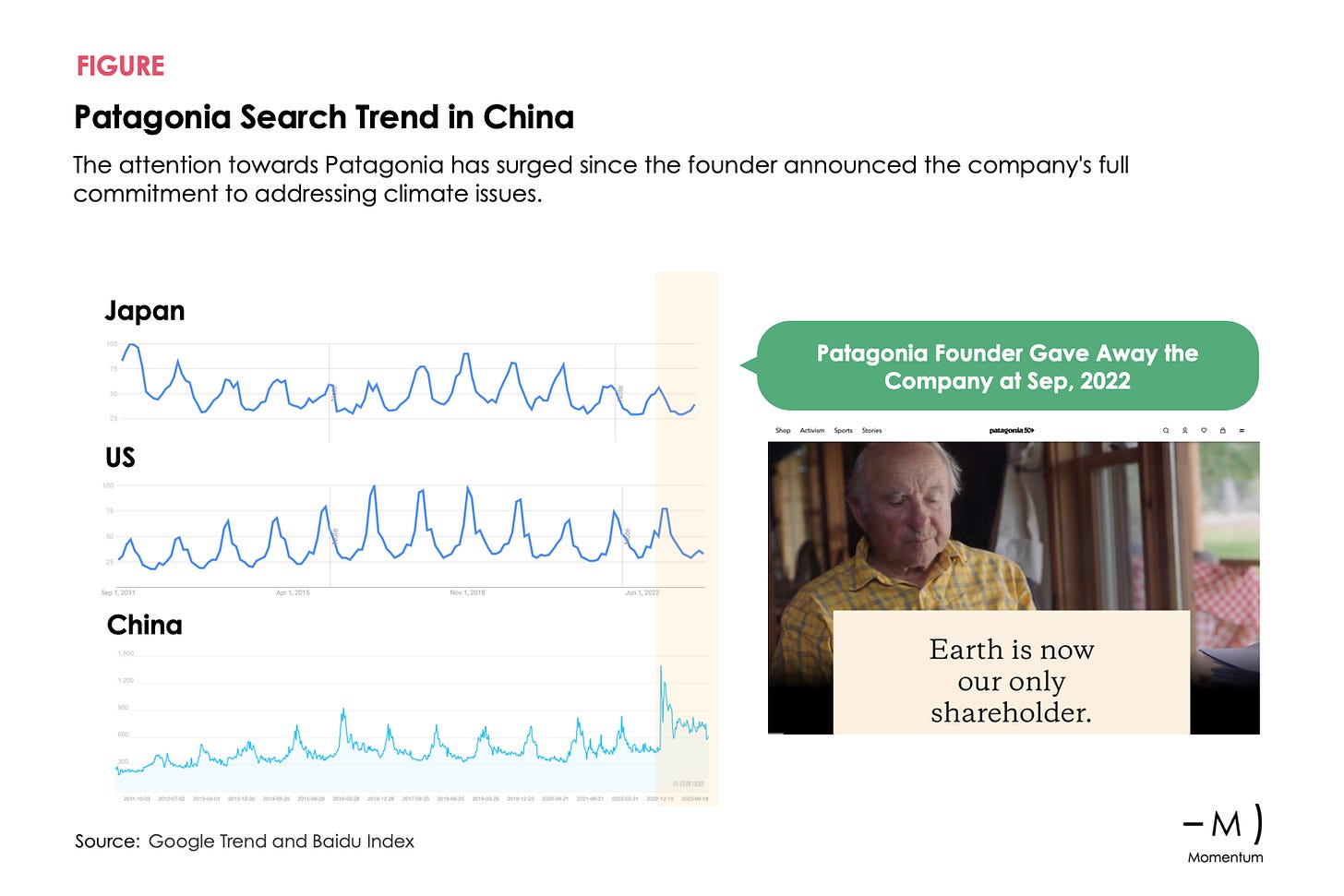

The early entry enabled Patagonia to gather a certain number of fans, but it didn't gain popularity in China until 2022 when the founder generously gave away the whole company to fight against climate change.

The brand's dedication to safeguarding nature and its noble business model struck a chord with middle-class Chinese consumers. As depicted in the figure, Chinese consumers' response to this campaign is considerably greater than that of American or Japanese consumers, primarily due to their significantly increased emphasis on environmental protection and sustainable development after the outbreak of the pandemic.

Of course, the examples of FREITAG and Patagonia do not imply that if you didn't enter China ten years ago, you have no chance. Many niche sectors still have room for green brands.

Aesop, an Australian beauty brand known for its use of plant-based ingredients, has faced obstacles in entering the Chinese market due to its stance against animal testing. Finally, in late 2022, Aesop successfully entered the Chinese market after the restrictions on animal testing were lifted.

Despite Aesop not being the first sustainable brand to arrive in China, the brand rapidly gained influence in the skincare category due to its distinctive design aesthetics and strong scientific research capabilities, which are rare and highly sought after by consumers. In just six months of being in China, Aesop has already set up three signature stores that are always buzzing with people.

Obviously, timing is crucial in fast-paced China. If you can identify an opportunity to be an early entrant in a specific niche with a product or service offering tangible value, then significant success is possible.

The Next Frontier

The sustainability segment is currently in its infancy. Despite FREITAG and Patagonia's remarkable strides, the potential of the market remains largely untapped. Consumers crave more sustainable products and knowledge, longing for a better way of life. Every consumer goods category offers boundless opportunities for a sustainable revolution.

But Chinese business evolves quickly, particularly when the full backing of the government looks set for the long term. This means that we are experiencing right now a unique window of opportunity for global sustainability players. Armed with strong products, a wealth of knowledge, and customer-centric strategies, companies can capitalize on regulatory support and position themselves for sustained growth in the vast Chinese market.

Nothing great lasts. It will be exciting to see how this area will evolve in the near future. Stay tuned for updates!