Beyond earnings — What’s behind Starbucks’ decline in China?

How long has it been since you last went to Starbucks?

What happened to Starbucks?

Starbucks China experienced its first single-store sales decline since the end of 2020. However, the brand did not garner any sympathy from the public. Instead, they were criticized as being arrogant, due to their lacking flavors and highly-priced offerings.

Consumers have been complaining about the product. Some coffee experts pinpoint bland beans and non-fresh milk as one of the sources of the problem.

Despite once being a top option in the coffee category, Starbucks' products fail to satisfy the increasingly discerning needs of Chinese consumers.

Customer complaints date back to 2022, showing that the problem has been mounting for years,

It's weird. I don't know if Starbucks' recipe has changed. It just feels like watered down, extremely bland. — May 2022, Xiaohongshu

I feel that Starbucks is becoming more and more bland. Whether it's a flat white or a latte. — Aug, 2023, Xiaohongshu

The taste is not amazing enough, why wouldn't I choose a cheaper brand to drink if the taste is almost the same? — May 2024, Douyin

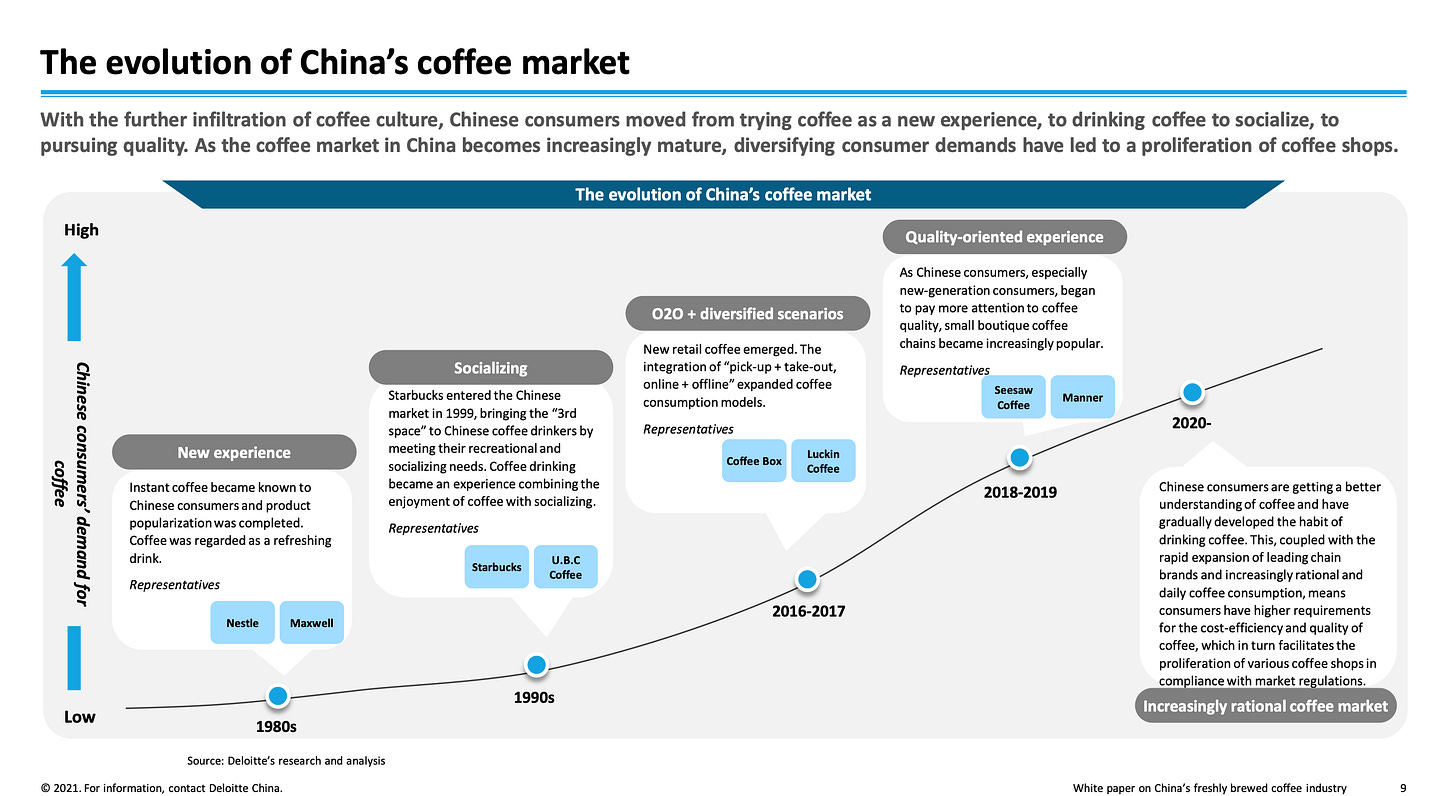

This is emblematic of a wider trend happening in the coffee market.

According to Deloitte, native consumers have transitioned from trying coffee as a new experience to seeking quality and cost-efficiency at the same time, due to the booming coffee culture and the rise of a rational consumption mentality since COVID.

The data speaks for itself: Starbucks, which has been slow to respond to the market, has become increasingly irrelevant to consumers' preference.

Market competition

Starbucks’ slow reaction allows local affordable high-quality and extreme budget coffee brands to claim a share of the growing coffee market.

Ubiquitous cheap coffee chains like Luckin and Cotti, generally offer beverages at quarter the price of Starbucks ($5). It has helped them attract entry-level coffee drinkers with their cheapest offerings coming under $1.3.

Specialty coffee chains like Manner and MStand, plus independent stores, provide superior quality at similar or slightly lower prices than Starbucks, appealing to avid coffee drinkers who are seeking distinct flavors.

As a result, today, apart from the inviting ambiance, customers are struggling to find compelling reasons to go to Starbucks.

Can Starbucks turn the tables?

In the face of growing competitors and pickier consumers, Starbucks has to carve out a compelling product proposition to stay competitive.

In order to solidify their place in the market, Starbucks is simultaneously taking a two-fold approach -– strengthening the product while offering discounts – with the hope, this will strategically position them between specialty and cheap coffee chains.

Quality-wise, they are enhancing the product appeal by introducing trendy beans, switching to fresh milk, and launching tailored products that cater to local tastes.

In my recent visit to Starbucks, two new products have impressed me — the Flat White, made with upgraded beans and fresh milk, and the “Iced Coconut” (椰椰双打), customized for Chinese coconut lovers with the perfect formula of coconut juice, coconut milk and espresso. In my view, both drinks are superior to similar offerings found at cheap chains, or even some specialty coffee shops.

(“Fresh milk” in this context refers to varieties that require refrigeration for freshness, including pasteurized and ultra-pasteurized options.)

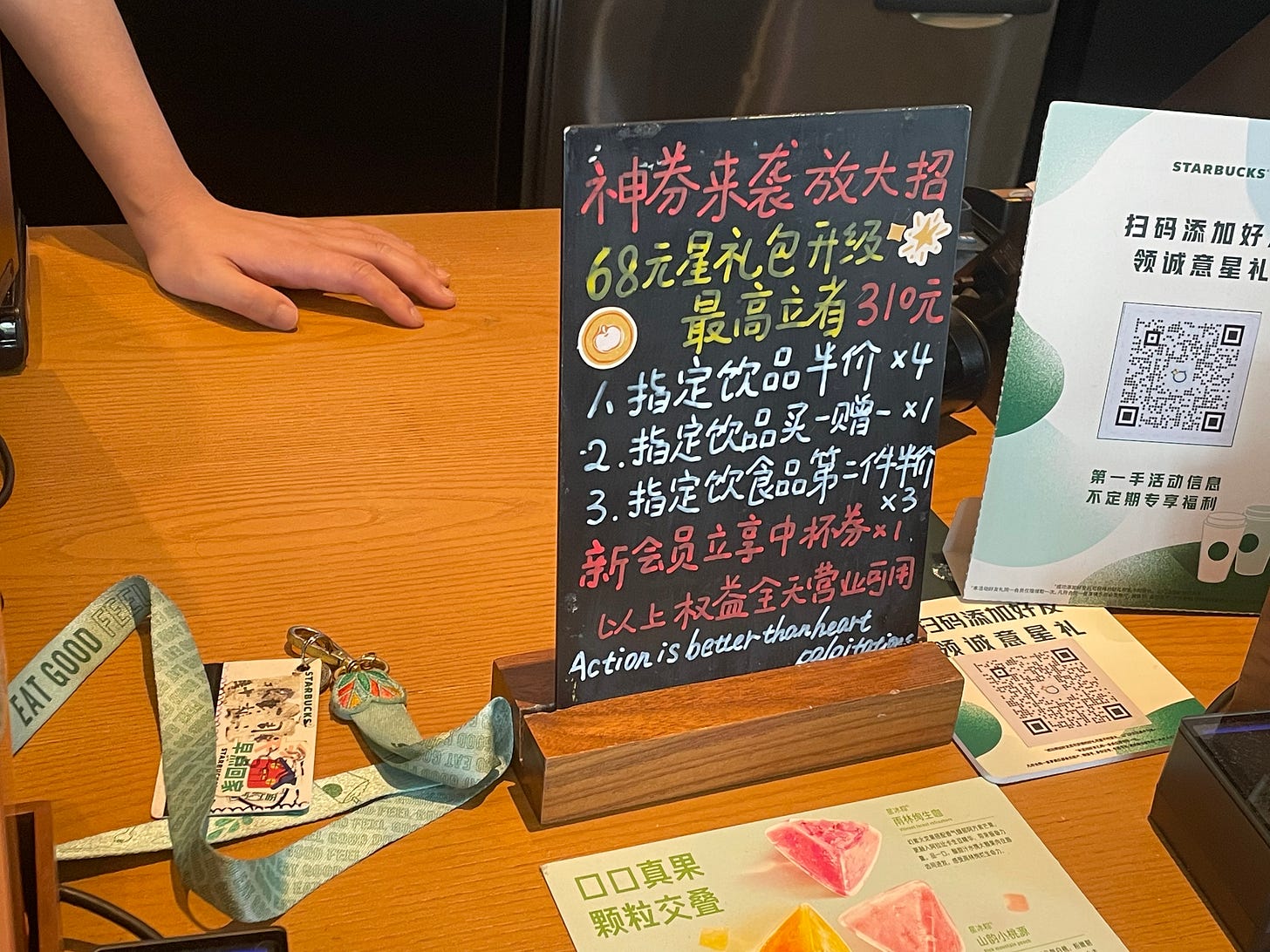

Meanwhile, they are promoting their offerings in a price range that falls between specialty and cheap coffee players, via selective, time-limited, and bundled discounts without a permanent price-cut.

Take the Flat White as an example again.

At Starbucks, it's currently available for 28 yuan ($4) when using coupons claimed on Chinese Yelp — Dianping, while it's 19 yuan ($2.8) through a membership program with 68 yuan ($10) pre-charge, down from its original price of 37 yuan ($5).

In comparison, a similar coffee at Luckin is 16 yuan ($2.3), at Manner it's 25 yuan ($3.6), and at MStand it's 34 yuan ($4.8).

This cautious multi-type discount system suggests Starbucks is testing the market response. They are seeking a new equilibrium between price, sales, and profit. If they are able to strike this perfect equilibrium, Starbucks will significantly strengthen their competitive edge.

With quality upgrades and cozy spaces, it's foreseeable that Starbucks might attract new clientele who've grown weary of Luckin's cheap offerings, and possibly regain some past customers who hold a sentimental attachment to the brand just like me.

Bigger picture

Looking at the bigger picture, Starbucks' expansion into lower-tier regions looks promising. With affordable offerings, Starbucks will be able to capture a broad demographic in these areas where personal income might be somewhat restricted.

However, one argument is that Starbucks' main price competitors, Luckin and Cotti, are already very aggressive in lower-tier cities expansion. They are leveraging even lower discounts than in the developed areas to appeal to customers when capturing new markets. If Starbucks wants to grow there, it will probably be engaged in a long-term discount battle, which might significantly impact the image and profit margin.

As we've seen in other sectors, such as the PC and auto industry, price battles are sometimes inevitable. If Starbucks wants to gain an advantage in low-tier areas by quick scalability, they even need to proactively dig deep into their pockets and tap into financial resources to leverage the price war to their strategic benefit.

Starbucks overall success in China ultimately relies on Starbucks accomplishing three fundamental steps:

Put out good products priced right

Get customers on board

Improve profit margins

Lesson for Starbucks – the glitzy signature cups that Starbucks sells for brand affinity will be empty if the coffee being used to fill them is not of good quality.