A few things on my radar #2

Fashion, Food & Beverage and Tech

Feature Story – Fashion

JNBY (江南布衣), a Chinese apparel brand, recovered from the “inappropriate design” scandal

In 2021, the horrific images on JNBY's children’s wear products triggered widespread condemnation in China. Consequently, in fiscal year 2022, JNBY saw a significant drop in children's and adolescent clothing sales.

Fast forward to Feb 2024, according to Growth Dragons, JNBY (SEHK:3306) saw its stock price surge by 27%. Its revenue increased by 26%, while net profit soared by 55%.

“These stellar results went against the notion that China is experiencing a consumer slowdown, and that the Chinese are pinching their wallets and would not spend big on luxury brands like JNBY,”said the author of Growth Dragons, Alvin Chow.

JNBY has a unique aesthetic.

I personally like one of their sub-brands — "Croquis (速写)." Their linen material, the drooping lines and wrinkles on the clothes give me a feeling of calmness and even elegance.

JNBY's continued success in large part stems from its robust membership system. Although their clothes are not cheap, after becoming a member, you can enjoy multi-faceted services such as outfit suggestions, discounts, and try-before-you-buy, which makes savvy consumers feel that it’s worth the value, and reinforces a sense of belonging to the brand.

However, in my opinion, JNBY cannot strictly be classified as a luxury brand - I might have a different view from Alvin Chow on this point. In fact, their price range is generally between ¥1000 ($150) - ¥3000 ($400), which belongs to the medium-priced clothes.

Overall, the revival of this brand just shows that the business between low-cost and luxury consumption still exists - consumers will always pay a premium for an exceptional product experience.

Here is my theory — Quality ÷ Price = Competitiveness in the Chinese market.

News Round up - Food & Beverage

Chinese food chains, BingZ and Kwa Food Fried Skewers, seek opportunities for global expansion

BingZ (西少爷), a Beijing-based fast food chain, looks to expand into the US market.

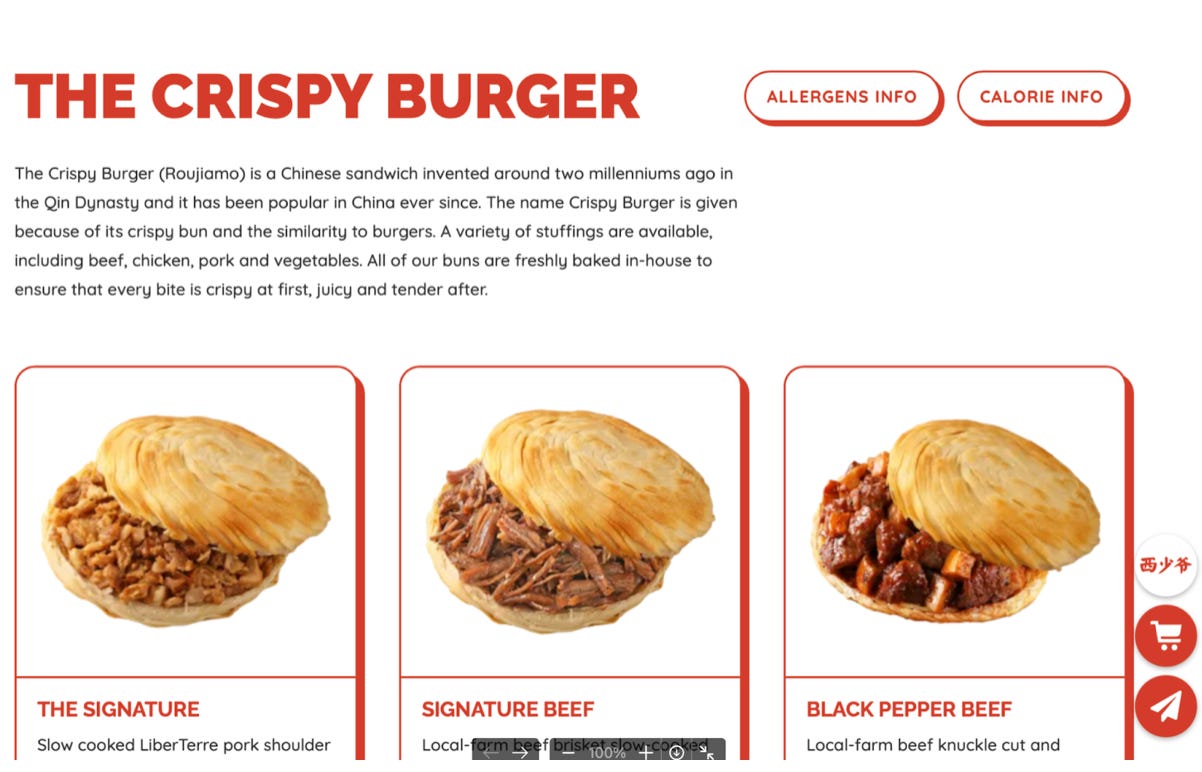

Established in 2014, BingZ offers Chinese cuisine . Their standout products is the Crispy Burger (Roujiamo), a Chinese sandwich invented approximately two millennia ago during the Qin Dynasty.

In 2021, they opened their first international restaurant in Toronto, Canada.

This April, BingZ raised funds from the US and the current company valuation reached $50 million. In the future they plan to open 3,000 stores across the US.

Kwafood Fried Skewers (夸父烤串) aims to open 3,000 new stores worldwide this year.

Kwafood Fried Skewers, a typical Chinese style BBQ brand, announced on February 26 that it has received new financing of ¥350 mil ($50mil).

As of today, They've already opened over 2,000 stores, including nearly 30 overseas in the US, Canada, Australia, Singapore, Malaysia and Italy.

Typically, Chinese cuisine offers a wide range of flavors and involves complex cooking techniques, making it challenging to standardized products compared to Western fast food. Yet, some Chinese innovators like Bingz and Kwa Food are ingeniously navigating this landscape by combining the standardization model of food chains like McDonald's with Chinese cuisine culture.

However, once they are able to standardize their products, the jury is still out about whether this type of fast food chain can succeed abroad?

A Partner of Tian Tu Capital (天图资本), a Chinese local VC fund, joins Sexy Tea (茶颜悦色), a domestic teahouse chain

Currently, Tian Tu Capital holds 14% of Sexy Tea's shares, making it the largest external institutional shareholder of the brand.

Late Post, a Chinese local business media, reported that Pan pan (潘攀), the Managing Partner of Tian Tu, joined Sexy Tea as the head of strategy in early April. Before that, Pan was responsible for the IPO project of Nayuki — China's first listed milk tea brand.

As of today, most of Sexy Tea's stores are concentrated in Hunan Province, limiting its reach as a national brand. Meanwhile, their peers have already expanded nationwide and even globally.

Sexy Tea is scaling up slowly. However, their peers are expanding aggressively. Perhaps Pan's arrivalis a signal that Sexy Tea wants to accelerate expansion and even the IPO progress to keep the brand competitive.

Shanghai launched China's first beverage nutrition grading system

In April, Shanghai introduced China's first Nutri-Grade system that rates beverages from A to D based on four key nutrients — added sugar, saturated fat, trans fat, and non-sugar sweeteners.

Beverages that are rated lower tend to have higher levels of sugar, saturated fats, and even other unhealthy additives.

According to the Shanghai CDC, 67 % adults and 90 %primary and secondary school students in the city regularly consume sugar beverages.

In fact, similar policies were implemented in France in 2017 and Singapore in 2022. This move has already affected Chinese brands operating in Singapore. For example, many of Luckin's best-selling beverages, such as the coconut latte, are graded D. Such a "nudge" has caused some customers to reconsider their purchasing choices.

Obviously, this grading policy, originating from Europe, will effectively encourage Chinese consumers to opt for healthier beverages and promote industry reformulation.

I guess this policy will mirror those of some European nations, impacting the entire food & beverage industry eventually. For junk food producers and sellers, they need to double-down on the fact that products are not healthy or create more health-oriented products.

A coffee store called Taijuan is selling $0.45 Americano in Shanghai

A Coffee store called Taijuan is offering coffee products that are mainly between ¥3($0.45)-¥6($0.9) in Shanghai.

The name Taijuan means “rolling inwards” in Mandarin, implying that they might want to engage in some low-level competition in the fiercely competitive red ocean.

This is the cheapest fresh-ground coffee I've ever had in Shanghai, and even across China, at the moment. Considering the cost of labor, equipment, utilities, rent, and the paper cup, $0.45 for a cup of coffee is practically a giveaway.

Taijuan Coffee couldn’t make their brand mission more obvious, even if they tried. Their name literally means rolling inwards and they’re clearly starting a competition around price. This is not a sustainable model for sure. It will have broad ranging impacts for many key players in the industry such as farmers and baristas.

News Round up – Tech

IPO Rumors about Chinese Instagram – Xiaohongshu

In late April, a local media outlet, IPOzaozhidao, reported that Xiaohongshu is in the process of financing at a valuation of $20 billion - perhaps a Pre-IPO financing.

Xiaohongshu says reports of new funding by IPOzaozhidao are “untrue”.

As reported by the Financial Times in March, Xiaohongshu secured its first profit — a substantial $500m last year, despite a $200m loss in 2022.

“Xiaohongshu is a better place for companies to build brand identity and relationships with customers than Taobao, where sales are pushed on to them,” said Plotnick, founder of Shanghai-based social media consultancy Wai Social.

Whether the rumors are true or false, the fact that Xiaohongshu has turned a profit for the first time shows that they have successfully balanced commercial needs and content quality, even during the economic downturn.

PR head of Chinese Google, Baidu, apologizes for her inappropriate comment

Baidu's Public Relations Lead, Qu Jing, encountered backlash after she revealed her ruthless and result-driven leadership style on social media.

“Why would I take the employee’s family into consideration? I am not her mother-in-law. I only need to consider whether she can give me immediate delivery results… you can opt out of these crucial tasks, but you will definitely have nothing to do with a raise,” Qu said in one of her videos.

On 9th May, Qu left Baidu, apologizing for her inappropriate comments and unprofessionally posting such videos without the company's permission.

Here are some comments by public audiences on Qu's remarks:

“No wonder Baidu can't succeed in anything, so this is their corporate culture.”

"Actually, the workplace is just so competitive, she just chose to speak it out."

"The actual situation is much more serious than she said."

Qu's words illuminate the current toxic leadership in the tech industry, such as the intense focus on immediate outcomes, excessive work loads, and a disregard for employee well-being. While her comments were deemed as inappropriate, it ultimately raises bigger questions about the industry work culture.