A few things on my radar #4

Figures; Electronic Goods; Sports & Fashion ; Food & Beverage and Entertainment

👋 Hello hello! Thanks for reading The Momentum. Subscribe for free to receive new posts and support my work!

Figures

May nationwide retail sales of consumer goods up 3.7% YoY

Retail sales reached ¥3.92 trillion ($540.42 billion) last month, up 3.7% year-on-year (YoY) , accelerating from a 2.3% rise in April and marking the fastest growth since February, beating the analyst forecast of 3%. Nevertheless, it was the third-lowest figure since last August, which may not completely alleviate concerns regarding tepid consumption.

As the table shows, all sub-categories of retail sales rose YoY apart from jewelry, cars, and building and decoration materials. And, sports & entertainment, electronics, and cosmetics saw double-digit growth, with sports & entertainment maintaining this trend for three consecutive months.

"Retail sales beat market (and our) expectations in May, but as was the case in previous months, sequential gains were focused on low-value discretionary products, reflecting still-poor consumer sentiment and spending capacities," the Oxford Economist said in a note.

Due to the challenges such as the housing slump, youth unemployment, layoff risks, and a sluggish stock market, a quick recovery in overall consumer confidence seems unlikely without more stimulus.

Nevertheless, consumers' pursuit of a better life has not stopped, but rather consumers appear to be more cautious and are avoiding large expenditures.

This month, over 10 million young talents are about to graduate, but their destinations may not be top-tier cities

Currently, China has 4 first-tier cities, 45 second-tier cities ( new first-tier + second-tier ), and 71 third-tier cities. Traditionally, graduates have been attracted to first-tier cities: Beijing, Shanghai, Shenzhen and Guangzhou. However, now, top second-tier cities seem more attractive than the big 4, according to The Economist analysis.

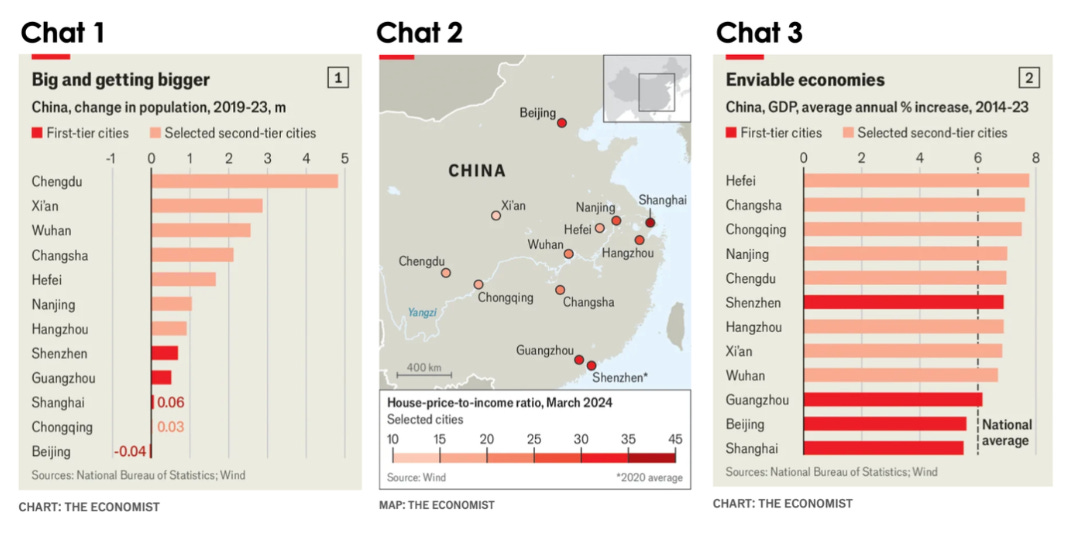

These top rising stars, including Chengdu, Xi'an, Wuhan, Changsha, Hefei, Nanjing, Hangzhou and Chongqing have fewer people than the big 4, but their populations are growing faster ( Chart 1). Such emerging cities have a financial benefit for newcomers due to their more affordable housing ( Chart 2). Some of them even offer extra incentives to attract talents. For instance, Hangzhou offers up to ¥15 million ($2 million) funding to PhD startup founders.

The top second-tier cities contribute about 10% to China’s GDP, which has grown at an average annual rate of 6% over the past decade. While first-tier cities saw similar growth, those leading second-tier cities outpaced them, with average annual growth rates of 7.2% (Chart 3).

The Economist's analysis indicates that China’s younger generations are increasingly seeking destinations away from intense competition. Top cities are no longer the sole dream locations, signaling that future economic development won't rely solely on first-tier cities.

Beyond The Economist's insights, Tier 3-5 cities, counties, and even rural areas are attracting young people due to untapped market opportunities and significantly lower living costs. Looking ahead, many overlooked regions may emerge as crucial in nurturing professional aspirations and fostering entrepreneurial ventures.

Electronic Goods

Apple Vision Pro is set to launch in China on June 28th

Photo Credits: WWDC Keynote

In early March, during a visit to China, Tim Cook, CEO of Apple, met with many app developers, consumer industry entrepreneurs and actors, to introduce Vision Pro prior to its official launch, according to his Chinese twitter, Weibo.

“When I showed him (Tim Cook) our offline space that will be opened in June, he said it was too cool, it was too suitable to put in Vision Pro, and he also looked forward to us designing a coffee shop with Vision Pro. It seems that Cook really values this business. Okay, I will try it on," said Wu Jun, the founder of Saturnbird, a domestic instant coffee brand.

On June 10th, at the Worldwide Developer Conference 2024, Cook announced plans for the Apple Vision Pro to be launched in markets outside the US, with pre-orders in China beginning on June 14th and official sales starting on June 28.

With iPhone sales facing challenges earlier this year, Tim Cook has become increasingly visible in Chinese media, indicating his deep concern for the successful debut of the Vision Pro in China.

Vision Pro is a visionary product, despite its immaturity. Its launch will likely serve as a strategic move to bolster Apple’s competitive image in China, especially at a time when the market has seen few exciting tech innovations.

While sales might be lower than what Apple expects due to its high price, the potential competition from Huawei and the fact that some Chinese fans have already acquired the product from the U.S., the Vision Pro will ultimately enhance Apple’s image as a leader in tech innovation, positively influencing the long-term sales of other Apple products.

Recent reporting shares that Apple has held talks to launch Apple TV+ in China, potentially becoming the only US streaming service available in the region

Photo Credits: Twitter Screenshot

Since last year, Apple has been trying to bring its Apple TV+ video streaming service to China through the most widely established telecommunication provider - China Mobile.

If the deal is sealed, Apple will gain access to a new market with 200 million viewers who already pay for traditional TV services. Additionally, Apple is also exploring ways to launch other services offerings like Apple Arcade and Fitness+ in China as well, as the Information reported.

Apple in recent years has bolstered its team responsible for subscription services like iCloud+ and Apple Music in the country, recruiting Chinese executives with experience at domestic firms including Meitu, Weibo and Tencent to scout for potential Chinese partners, said 9to5mac, a tech media outlet.

The timing of the Vision Pro debut and signals of Apple TV+ entering the market is likely no coincidence. Apple seems intent on introducing more VR-related services to coincide with the sales of the Vision Pro.

Currently, several key VR services, including Apple TV+, Fitness+, and Arcade, are not fully available in China. The successful launch of Apple TV+ could generate immediate revenue and potentially open the door for more Apple services in China, enhancing user experience and loyalty to Apple products in this market.

The Bigger Picture,

Apple TV+ might become the second US streaming service permitted in China after the NBA. This may not suggest a loosening of CCP censorship, but it does indicate that distributing content in China is still feasible in someway within the current regulatory frameworks. Could we see more Western streaming services entering China?

Sports & Fashion - lululemon

lululemon's Q1 growth in China reached incredible 45%

Since 2022, lululemon has demonstrated intentions to expand out of top-tier cities. In 2023, most of the new stores are outside of the first-tier cities. Earlier this year, the brand officially launched its flagship store on Douyin, Chinese Tiktok, selling discounted products via live streaming, mainly targeting consumers in remote cities that the store has not yet reached.

Product-wise, they are synchronizing with global trends and expanding their product lines beyond yoga products touching multi-sports aspects and even leisure apparels. This year, lululemon began to increase their efforts in the men's clothing business, signing Chinese F1 driver Zhou Guanyu (周冠宇) as their ambassador.

In fiscal Q1 '24, lululemon saw a modest 3% increase in sales in the Americas, in stark contrast to a substantial 35% increase in the international market, especially fueled by a 45% growth rate reported in China.

lululemon's growth in China has been nothing short of astonishing, and I believe two crucial factors contribute to this remarkable success:

First, domestic competitors simply haven't measured up. While numerous local brands have aspired to replace lululemon, they struggle to pose a significant threat. In terms of design and materials, these emerging brands fall short, leaving lululemon as the preferred choice for quality and chicness.

Second, the beyond-yoga expansion of the lululemon product line aligns perfectly with the booming interest in both yoga and outdoor activities across China. Additionally, lululemon's strong bet on lower-tier markets aligns with the nationwide spread of this sports culture and the trend of rising consumption in smaller cities.

On a related note, some foreign brands like Vuori have just entered the market to seize growth opportunities. We may soon see other international brands following suit — could the renowned Alo Yoga be next?

Food & Beverage - LELECHA and Yea 3

In April, LELECHA, a Chinese bubble tea brand led by Nayuki, a HK listed bubble tea chain, started to replace their milk materials with natural organic ones

Since August 2023, LELECHA has started sugar content control, reducing sugar amounts by 10% to 25% across their entire product line.

On April 7th, LELECHA upgraded the milk used in five products to organic. The organic milk can be found in their four types of milk tea and one baked item.

This is part of a larger trend.

Chinese consumers are increasingly focusing on the safety and healthiness of raw food materials. Coupled with the potential national implementation of a nutrition rating system, many food and beverage companies are improving their ingredients, reducing sugar, and enhancing traceability to meet market demand.

To me, this is absolutely great news — these changes might even add a few more healthy years to my life.

Yee3, a Shanghai-based coconut beverage chain, opened its sixth outlet in Hangzhou in June

In November 2023, "Yee3" opened their first store in Shanghai. Currently, they have already launched six stores nationwide, located in Shanghai, Beijing, and Hangzhou.

Yee3 has currently launched 19 products. "We hope to become the top brand of fresh made coconut beverage chain in China," said Vian, founder of Yee3.

In 2023, China's coconut imports totaled 1.18 million tons (up 10% year-on-year) and $580 million (up 2% year-on-year) , with Thailand, Indonesia, and Vietnam being the main suppliers.

While coconut is a stable ingredient that’s been around for years, Yee3 is changing the game by trying to elevate coconut to a core product offering.

According to my observations, the secret formula of Yee3 products is elevating coconut juice by offering innovative coconut beverage products such as a coconut juice topped with cheese cream foam and sprinkled nuts.

Needless to say, in a seemingly competitive beverage market, creating an entirely new category is a very effective way to innovate.

However the jury is still out as to whether this new innovative product will take china by storm?

Entertainment — Black Myth: Wukong

Black Myth: Wukong (黑神话:悟空, BMWK), a video game developed by a Chinese studio, garnered significant attention and sales following its pre-order launch on June 8th

China's first triple-A video game, BMWK, which began pre-sales on June 8th, has become a major hit in the two months leading up to its official release. As of Jun 17th, pre-orders for physical copies have already surpassed 1million.

The game draws inspiration from one of the four great classical novels of Chinese literature, "Journey to the West (西游记)." Its general plot is about the Monkey King, the superhero in the novel, who goes through wild adventures with other pilgrims in their quest for Buddhist scriptures, said Gamesradar.

A rumor posted on Chinese social media on June 7th claimed that the developer of BWMK rejected a $7 million 'extortion' attempt from a DEI (diversity, equity, and inclusion) consulting firm named “Sweet Baby Inc (SBI).” Consequently, IGN, a prominent gaming media outlet allegedly connected to this consulting firm, has been criticizing the game and calling it out for sexism since its original trailer release.

This rumor sparked considerable discussion among gamers after it was reposted on Twitter on June 14th. Many game players and industry insiders have publicly expressed their condemnation of IGN and SBI and their support for BMWK. "I was already going to buy the game, but I think now I might have to buy it twice,'' exclaimed Zack, a well-known game reviewer, in his YouTube video.

From their trailers, the game stands out with its classic Chinese-style music, sophisticated character designs, realistic landscapes, and a rich tapestry of Chinese cultural heritage woven into every detail.

The recent controversy involving SBI and IGN has thrust the already eagerly awaited BMWK further into the limelight. Instead of dampening enthusiasm, this incident has only fueled their excitement and determination to experience the game firsthand.

IGN and SBI have not yet publicly responded to the rumor. Will they fight back?