A few things on my radar #5

Food & Beverage, Jewelry & Accessories, Tech and One More Thing

👋 Hello Hello. Thank you for reading The Momentum! Subscribe for free to receive new posts and support my work.

🌟 Featured Story — Food & Beverage

The steep drop in Moutai's baijiu product wholesale price has raised concerns about the brand's future

IWSR forecasts the spirits industry in China to contract at a volume CAGR of -4% from 2022 to 2027. All other spirits categories such as whisky, vodka, and agave are expected to grow, except Chinese white liquor (baijiu). Since 2017, China's baijiu production has dropped from 11.98 million kiloliters to 3.958 million kiloliters in 2023, a three-fold decline.

Moutai, the world's most valuable alcohol brand, is a luxurious status symbol used for gifts, weddings, political or business banquets and even collections due to its history, quality, and scarcity. Even in industry downturns, Moutai has been maintaining growth momentum in revenue for years.

However, Moutai's hero product average market prices have recently fallen by 8% since April, raising concerns about the consumption of high-end discretionary goods in China, said SCMP. The rumors say this is likely related to the shrinking real estate sector, which has led to a sharp decline in business banquet.

Some analysts firmly believe in the long-term value of Moutai. “Moutai, we believe that a price below ¥1,500($200) is attractively priced. With a PE ratio of 24x, which is below its 5-year average of 40x, it offers a good margin of safety. Of course, there remains a chance for further downside before it recovers, but the exact timing is uncertain,” said ALVIN CHOW, the author of Growth Dragon.

The real crisis often hides behind flashy headlines.

Moutai's real challenge is losing future consumers, as young Chinese aren't as into baijiu as older generations. Older Chinese generations born in the 60's and 70’s are well accustomed to dining manners with a strict hierarchy and see forcing others to drink excessively as a form of enjoyment. But the young generations are trying to escape from this drinking culture. Today, baijiu is seen as uncool and is the last option for younger social gatherings, according to RIES Consulting.

“Young generations are less enthusiastic about hierarchical dining culture than the older generation. They prefer to drink freely rather than please those in power, sometimes being forced to drink to drunkenness,” says Shu Yang, a podcaster involved in a baijiu startup. “Baijiu, a staple at these meals, discourages young people rather than attracting them.”

Needless to say, If Gen Y and Z no longer desire current baijiu culture, even leaders like Moutai will struggle to stay attractive. Recently, Moutai has been trying to update their design and leverage non-alcoholic products to woo the attention of younger generations. However, these efforts are too superficial, don't really match what young people want and, sometimes, even make the brand seem less luxurious.

Their new mascot, aimed at younger consumers, looks outdated, making me doubt their brand team's aesthetic sense.

Moreover, the Moutai ice cream package frosts over when taken out in their flagship store, showing poor temperature control. The texture feels kinda cheap compared to gelato, which is pretty surprising for something that's supposed to be a "luxury product."

Additionally, the once-popular combo of Moutai and coffee brand Luckin isn't doing so hot anymore. I think it's because many just don't like the taste of mixing Moutai and coffee. Honestly, I can't wrap my head around why Moutai would risk its premium image to make such an underwhelming coffee.

Putting aesthetics aside, Moutai’s recent product portfolio expansion into trendier western food and beverages that appeal to primarily younger generations was poorly executed and was a questionable strategy to undertake.

These offerings do not represent their core brand identity. When you think about Moutai, you think about baijiu, not ice cream. Their brand identity is built on luxury baijiu, and this has been Moutai's bread and butter - it's winning recipe for decades. Moutai should come up with some innovative strategies centering around baijiu — that's what they do best — to attract new customers.

In my view, to get younger consumers on board, they don’t even need to expand their product lines, but rather reinvent the baijiu culture to fit changing generational preferences. There is a need to fundamentally rethink the way younger generations drink and engage with baijiu. If Moutai can manage to make young consumers associate baijiu with pleasant and comfortable dining, they will be able to capture younger generations.

News Roundup

🥤 Food and Beverage

Food safety scandal: two Chinese food companies, Sinograin and Hopefull Grain and Oil Group, are facing backlash for using the same trucks to transport cooking oil and fuel without cleaning them in between

On July 2nd, Han Futao, a Beijing News journalist, reported an “open secret” in the transportation industry: some well-known brands' oil tankers were cutting costs by using the same tankers for fuel and cooking oil without cleaning them in between.

Two companies are caught in this mess: state-owned Sinograin and private Hopefull Grain and Oil Group. Other cooking oil companies deny involvement.

This scandal has angered the public, compared to the “poisoned milk scandal” a decade ago. "Food safety is the most important issue," said a Weibo comment liked over 8,000 times.

Such behavior was "a blatant provocation to the 'Food Safety Law' and showed extreme disregard for consumer life and health," said CCTV, the CCP’s mouthpiece.

China's Food Safety Office is investigating edible oil transport and promised to hold anyone involved in misconduct accountable.

After the scandal outbreak, cooking oil sales have increased at Hong Kong supermarkets and some stores in northern border districts. “They are a bit expensive, but food safety matters,” said a consumer who had bought six bottles of HK brand oil.

Since the early 2000s, food safety issues have been frequently reported. Especially the 2008 toxic milk powder scandal which severely damaged trust in the dairy industry and even the food industry as a whole. Despite efforts to rebuild trust, today's cooking oil scandal raises another concern — whether food safety has truly improved or many issues are suppressed due to the speech censorship.

As China’s economic growth has helped address issues like starvation and food poverty, citizens are beginning to prioritize their health more than ever. A street food owner skimping on hygiene for survival might be understandable, but large enterprises like Sinograin who willingly cut hygiene to save money at the cost of endangering consumers’ health shows a level of unforgivable moral degradation.

While Sinograin and Oil Group have taken the heat for this scandal — there remain unanswered questions about who owns the trucks? Who ordered the oil? Where did the polluted oil go? How many current products are affected? I'm unsure how far the CCP's investigation has progressed, but these are the questions that consumers should be most concerned about.

No doubt, food safety is a major challenge for the ruling party now. Such incident shows significant regulatory loopholes. Beyond punishing offenders, it's crucial to enhance supervision of the entire food supply chain, not just final product sampling inspections, to prevent food safety risks. Failure to address this issue could lead to not only mass health concerns, but cause Chinese consumers to lose confidence in Chinese food brands once again.

In late June, "9.9 Coffee House," a budget specialty coffee chain born in a second-tier city, opened its fifth local store

In 2022, 9.9 Coffee House opened in Nantong, a second tier city in Jiangsu Province. Similar to Taijuan Coffee mentioned in my previous post, it aims to sell cheap coffee, as indicated in its name.

Unlike cheaper places like Taijuan or Luckin, 9.9 Coffee House sells high-quality coffee like Manner but offers lower prices by being extremely economical on fixed cost.

9.9 Coffee House is selling all American-style coffees at ¥9.9 ($1.5), and milk-based coffees range from ¥15 ($2) to over ¥20 ($3) based on bean quality. Basically, all products are about ¥5 ($0.8) cheaper than similar products from Manner, a doesmtic specialty coffee chain.

Now, the brand owns five stores but the founder only accepts franchise models, rejecting any capital investment.

Outside top-tier cities, the coffee culture is still developing, and specialty coffee chains yield low coverage.

Specialty coffee chains haven't penetrated many cities where coffee giants Luckin and Starbucks, who have a strong grip on the coffee industry, have already arrived. There, the coffee culture is slowly taking root due to the arrival of these giants, while specialty coffee culture is not led by chains but local independent coffee shops. Due to the supply scarcity of superior coffee, some of their pricing could be higher than Starbucks and even the counterparts in top-tier cities.

These cities, which have already been affected by coffee culture, should have been targets of specialty coffee chains, especially Manner, which is able to provide consumers with better coffee at a lower price. However, the operation of a specialty coffee store is very heavy, which does not allow them to expand rapidly as Luckin or Starbucks do.

Taking Nantong as an example, where Starbucks and Luckin have around fifty stores respetively, plus hundreds of local independent stores, Manner has not yet come to Nantong (this is the hometown of Manner's founders, I don't know why they choose to ignore this city).

Local coffee store, 9.9 Coffee House, has taken advantage of Manner’s absence to sell cheap specialty coffee in Nantong by using a similar model to Manner. Their product is as good as Manner, and even slightly cheaper. They keep prices low by having lower fixed costs than Manner — they leverage small stores to save on rent, and use cheaper semi-automatic espresso machines to get their investment back faster.

To me, their model is more conducive to expansion because the fixed input cost is low. Additionally, because the pricing is lower than Manner, even if one day Manner enters their territory, they will not lose the competitive advantage.

9.9 Coffee House's success in Nantong demonstrates a market gap in the specialty coffee sector. As long as it is a city similar to Nantong — where coffee culture has already arrived, but affordable specialty coffee products are absent — it is an opportunity for 9.9 Coffee House, and other chains with similar models to jump in and make full use of it.

In June, ALDI, a German grocery chain, launched a ¥9.9 ($1.5) baijiu product in China, and it keeps selling out

Grocery chains have seen more shoppers buying their own brand products. In 2022, private brands made up 5% of total sales among China's top 100 supermarkets, up from 4.1% in 2019 and 3.2% in 2018, according to a 2023 report.

To jump on this trend, ALDI has increased its private-label items to 90% in China. Roman Rasinger, Managing Director at ALDI China, said Chinese consumers are more rational, focusing on value and quality, which is an opportunity for ALDI’s private-labels.

In June, ALDI launched a ¥9.9 500ml 52-degree baijiu, which is made from five pure grains (sorghum, rice, glutinous rice, wheat, corn) and water, fermented using the solid-state method.

Some people are asking on social media, "Can pure solid-state fermentation really be done at this price? It must be blended." But consumers who have truly tried ALDI baijiu are very supportive of this product, “Similar local products can't compete on cost, so they're just taking shots at ALDI. ”

“In theory, ALDI's prices can cover the brewing costs, but the profit is very small. Meaning, ALDI has to strictly control operating costs,” said Xiao Zhuqing, an expert in the liquor industry.

ALDI, eager to expand its private label in China, likely didn't expect its first hit product to be baijiu, possibly the first foreign baijiu brand in Chinese history.

ALDI's baijiu is popular for its affordable price, decent quality, and sleek packaging. Currently, no brand on the market with the same quality baijiu products can sell at such a low price. Moreover, unlike bulky local brands, it looks much cooler and feels good in hand. I can't find any faults with this entry-level product, except its short supply.

The red-hot baijiu product is also shining a light on other cheap ALDI-owned goods that span across categories like food, drinks, beauty products, and cleaning supplies. Those products, in fact, are as competitive as baijiu, and are gradually winning consumers' attention.

Since this strategy seems to work very well, they're likely going to expand such product lines into more categories to meet diverse local demands.

💍 Jewelry and Accessories

On June 28th, Laopu Gold (LG; HKG: 6181), a Chinese gold jewelry brand, was officially listed on the Hong Kong stock market with a soaring stock price

LG, founded in 2009 by Xu Gaoming, started as a boutique and pioneered the traditionally crafted gold jewelry (古法黄金) concept. The brand now has 33 stores across 14 Chinese cities and all stores are located in the prime locations. Entering LG's store is like stepping into the old Forbidden City, with its elegant design, sophisticated products, traditionally dressed staff, and rich stories behind each lavish item.

In 2023, LG's revenue hit ¥3.18 billion, growing 145.7% year-on-year. LG has kept an excellent gross margin above 40% for 3 years, compared to the industry average of 10%-20%. Until today, LG's stock price (HK$81.5) has doubled from its IPO price (HK$40.5).

"Consumers called it 'the best gold' and mentioned it with brands like Cartier and Bulgari. Everyone is willing to recommend it to friends. Achieving this pride is difficult for a Chinese brand," said BA Capital (黑蚁资本), leading the first private financing round of LG before IPO.

According to the prospectus, LG plans to open stores in Singapore, Tokyo, Bangkok, and Kuala Lumpur in the future.

LG's success is partly due to rising gold prices, exciting Chinese consumers to buy and invest in gold more. Additionally, its high profits show its strong brand premium — I feel like LG wants to establish a luxury brand, and they know exactly what luxury goods are selling — a fantasy built on noble history, complex handmade craftsmanship, classy looks, and scarcity.

When it comes to China's gold jewelry market, the top 4 gold jewelry chains own over 40% of the traditionally crafted gold jewelry market, while LG only has 2%, ranked 7th. But honestly, I don't think LG needs to worry too much about market share. As a luxury brand, LG needs to continuously retain a strong, high-end image in the minds of consumers, even if this comes at the cost of slow expansion.

In the end, can LG make a dent internationally too? Well, that's up in the air right now. Picking Asian countries with similar cultures where gold is also seen as a symbol of identity and status for their first international push is a pretty safe bet. But whether they'll make it big worldwide is something to keep an eye on.

Tech

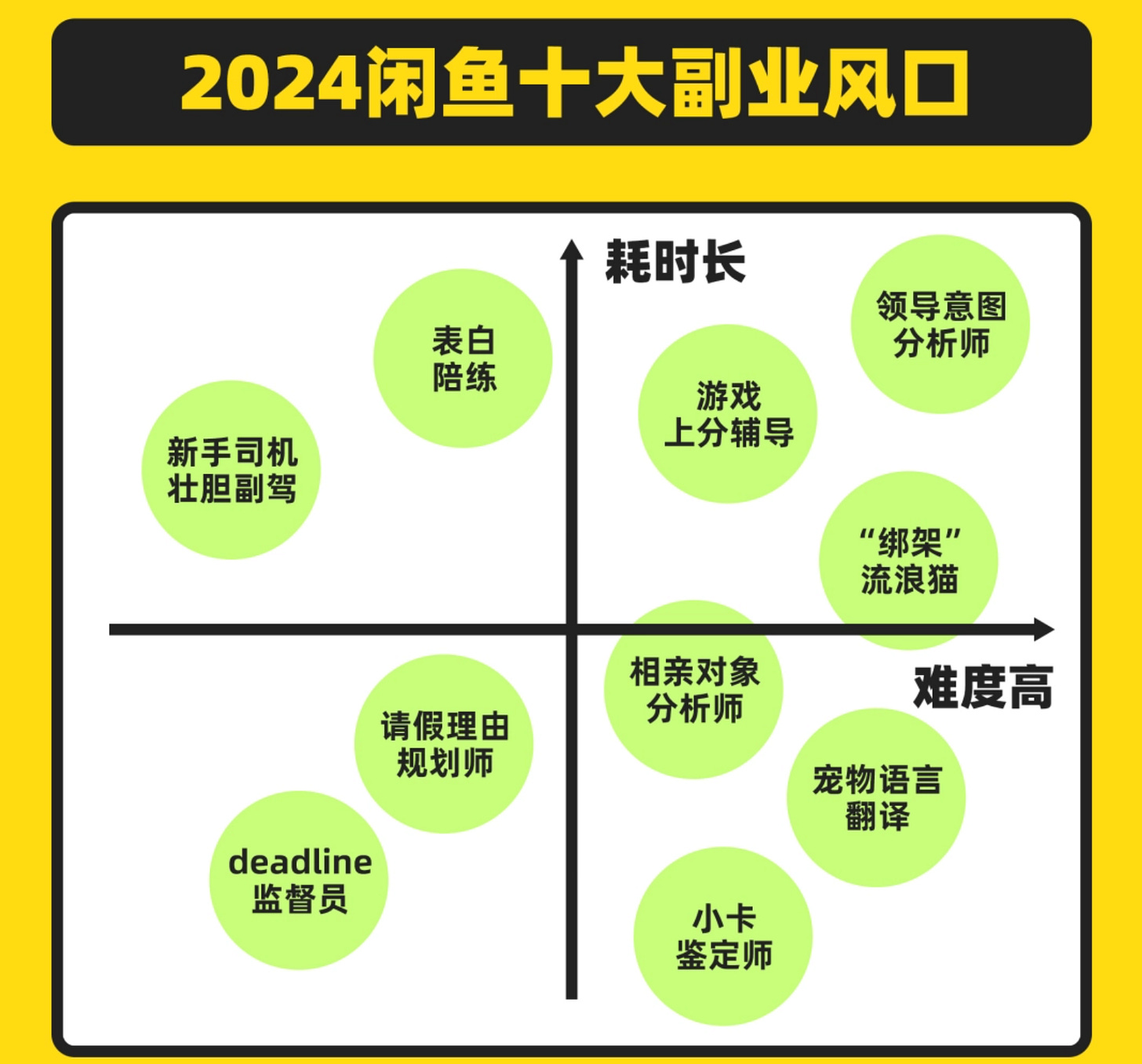

Earlier this month, Xianyu, a top Chinese used-goods trading platform, launched a part-time job function to help young generations make money

Alibaba's second-hand platform Xianyu has over 500 million users, 43% born after 1995, and averages over ¥1 billion ($140 million) in daily gross merchandise value.

With high unemployment in younger generations in China, Xianyu launched "Xianyu Resume" in early July, helping users find additional job opportunities Before the resume feature launch, over 7 million Xianyu users were already engaged in side businesses on Xianyu, earning an average of ¥2,500 ($370) each.

Xianyu has also expanded its business beyond used goods trading to rental housing, ACG (anime, comic, and game) culture, trendy toys, and end-of-season clearance.

Ji Shan, CEO of Xianyu, announced that they will transform from a second-hand trading site to really leverage their resources to feed younger generations' demands. In the next three years, the brand goal is to help users save money, make money, and also have fun.

Since 2022, the Xianyu ecosystem has grown from a second-hand marketplace into a complex trading community among young generations. They are expanding into Xiaohongshu’s territory to tackle something that Xiaohongshu hasn’t done well. In my view, opposite to Xiaohongshu, which promotes spending, Xianyu actually encourages saving and earning money. In short, both platforms seek to enhance the audience's quality of life but just in different ways now.

With China's economic recovery uncertain, Xianyu's new plan wisely caters to the trend of people being careful with their spending. Especially for many young people, stuck in joblessness or work stress, who have less money and feel negative, saving and making money are their key demands.

According to 21st Century Business Herald, Xiaohongshu, China's answer to Instagram, is intending to lay off 30% of its employees

As I mentioned in my previous post, Xiaohongshu, a Chinese social media and e-commerce platform, has secured its first profit of $500m in 2023, despite a $200m loss in 2022.

Despite excellent performance, Xiaohongshu may still face massive layoffs. The reason is rumored to be that higher-ups are not satisfied with Xiaohongshu's staff efficiency, which is less than half of Pinduoduo.

In 2023, Pinduoduo's revenue per employee led Chinese tech giants at ¥14.22 million ($2million), 3 times Alibaba, 6 times JD.com, and 2.5 times Tencent.

It's hard to say whether Xiaohongshu's pursuit of Pinduoduo's efficiency is right or wrong.

Finding a balance between a robust content community and seamless e-commerce is ideal. However, easier said than done. Overly emphasizing efficiency might unintentionally damage the original content quality and creative atmosphere of Xiaohongshu.

What is their answer to the market and why are they chasing efficiency at this point in time after securing their first major profit? Given the fact that this rumor is still in the early stages of potentially unfolding, only time will tell what Xiohongshu is really up to here.

🎵 One More Thing

June 30, 2024, marks 31 years since the passing of Wong Ka Kui, the lead singer of Hong Kong rock band “Beyond.”

Wong’s music transcends time, space, and language, resonating with all audiences. Even mainland Chinese who don't speak Cantonese can sing lines from Beyond.

Before you go, let me share Wong’s last hit with Beyond, "Boundless Oceans, Vast Skies(海阔天空)" — a pinnacle of C-pop until today.