A few things on my radar #21

Moutai, HILEFIT and JAM

👏🙋Hello, hello! Thanks for reading The Momentum — an independent publication without ads or affiliate links. Feel free to subscribe to receive new posts and support my work!

Moutai 🍶

Moutai reported its weakest six-month growth in years, said Bloomberg

First-half revenue increased 9.2% from a year earlier to 91.09 billion yuan ($12.7 billion), while net income climbed 8.9% to 45.4 billion yuan, the company reported Tuesday. Those are the slowest semiannual increases since at least 2016.

The wholesale price of Moutai's flagship product—Feitian—continues to decline, hitting record lows as consumer spending drops amid economic uncertainty and government restrictions on officials' drinking. (According to Bloomberg Intelligence, Feitian's 2024 and 2025 wholesale prices have fallen 16-17% year-to-date.)

However, Moutai's earnings have actually been largely protected from wholesale price fluctuations. This is because Moutai sells its baijiu to distributors at a fixed price of 1,169 yuan per 500 milliliter bottle.

According to baijiu expert Cai Xuefei, government consumption has plummeted from over 40% in 2012 to less than 1% in 2025. Business events, family gatherings, and personal use now dominate. Meanwhile, Moutai has increased its appeal to younger demographics, with young customers now representing 45% of their base.

While Moutai's record-slow growth and falling wholesale prices reflect very real headwinds from economic softness and official alcohol restrictions, this may not be a story of terminal decline. Instead, it could be the painful but necessary transition of a legendary brand.

The current market pressure is forcing Moutai to evolve in positive ways: the decreasing retail price is making the product more accessible and broadening its consumer base (clearly, the frequency with which I've been drinking Moutai with friends has significantly increased in the past two years), particularly among younger generations, helping to offset consumption challenges from existing customer groups.

Additionally, the official alcohol ban campaign presents a historic opportunity for Moutai—long considered essential for bribery and formal official banquets—to shed its negative political associations and reshape both its brand image and Chinese baijiu culture as a whole for a more sustainable future — just as I experienced in Guiyang, Moutai has many possibilities beyond its negative context.

HILEFIT(乐刻)🏋️

HILEFIT Fitness surpasses 2000 locations, leading all Chinese fitness brands

Gym scams are common in China, where consumers who lack fitness knowledge are often duped into purchasing extremely long-term gym memberships or training courses. Many gyms become obsessed with this model while neglecting operational costs, leading to financial collapse. Recently, SCMP reported that a man was even inexplicably tricked into paying for 300-year gym memberships.

In 2015, HILEFIT entered the fitness market with its "monthly payment + no sales pitch" model, boldly fighting against mainstream gyms were relying on "prepaid annual cards + personal training packages" to monetize users. Leveraging its internet attributes and lightweight operations, as of July 2025, it has over 2000 locations across 40 cities nationwide, with more than 14 million registered users, becoming China's largest fitness chain brand.

China's fitness industry is expected to cross 100 billion yuan in 2026 (US$13.8 billion), compared with 70.6 billion in 2021, according to Statista.

HILEFIT's core advantage lies in its precise targeting of long-standing pain points in the fitness industry (excessive sales pitches and annual membership commitments), attracting massive user numbers through its disruptive "no sales pitch" and "monthly payment" model with extreme value for money. Its deeper competitive strength comes from a powerful digital middle platform system, achieving refined management and high efficiency in operations, building a scale barrier that's difficult to replicate.

Currently, HILEFIT firmly holds the position as China's market leader by size, ranking among the global first-tier chains in terms of location count alongside international giants like Anytime Fitness and Planet Fitness.

Inevitably, HILEFIT also faces threat from the peers — another brand called Zhongtian(中田) Fitness, which differentiates itself with "community-based locations + unlimited monthly personal training sessions," also targets 2000 locations this year and is closing the gap with HILEFIT .

JAM (JD, Alibaba and Meituan ) 🛵

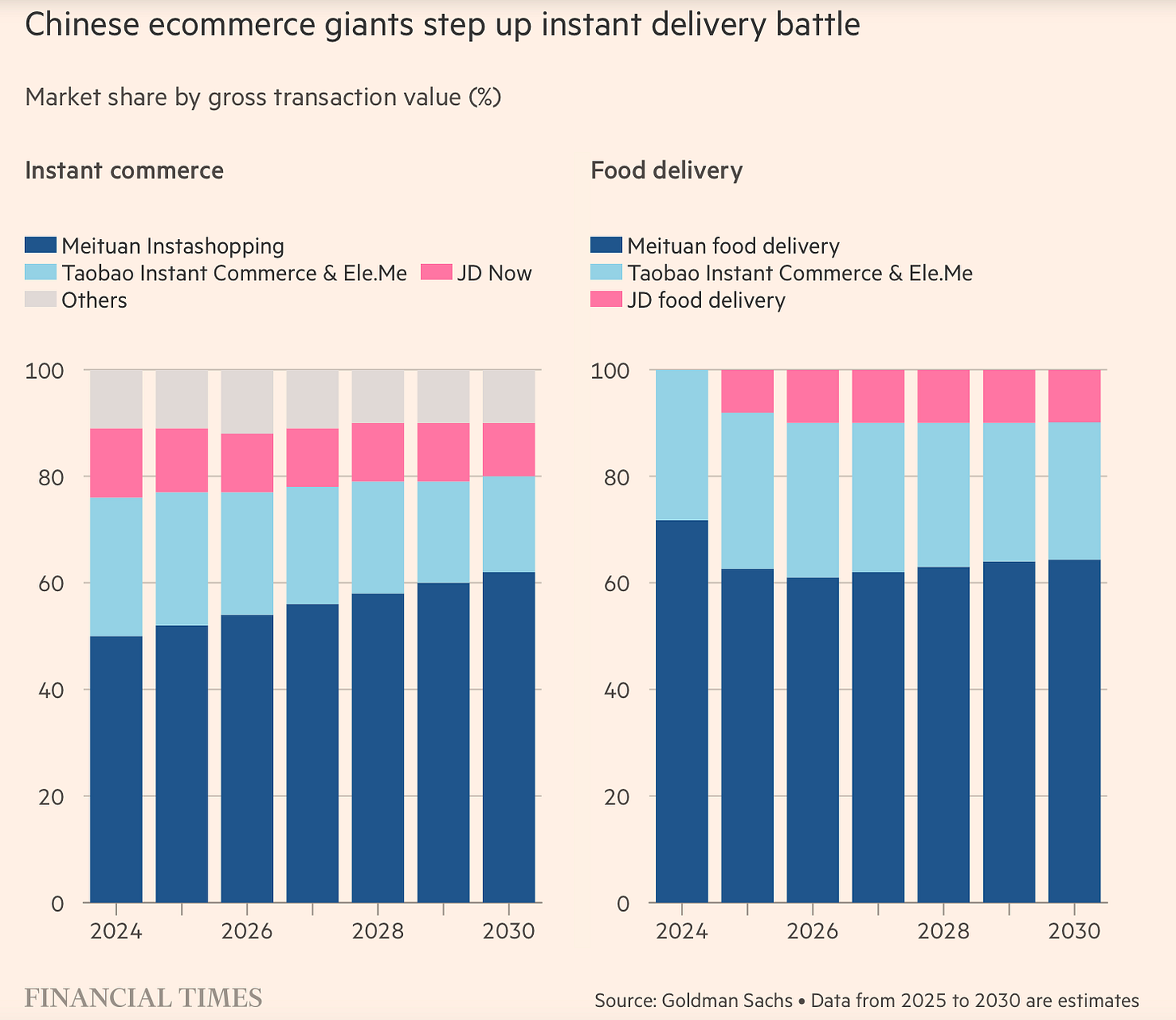

China's tech giants' battle for instant delivery market leads to significant profit declines

JD: Net profit halved by 50.8%, new business losses reached 14.8 billion yuan, marketing expenses surged 127.6% year-on-year to 27 billion yuan.

Alibaba: Non-GAAP net profit decreased by 18%, sales and marketing expenses reached 53.2 billion yuan, free cash flow showed a net outflow of 18.8 billion yuan, but instant commerce drove a 25% increase in e-commerce user activity.

Meituan: net profit plummeted 89% year-on-year, core local commerce operating profit margin dropped sharply from 25.1% to 5.7%, sales and marketing expenses reached 22.5 billion yuan, up 51.8% year-on-year.

What appears to be a brutal "World War II" in food delivery is, in reality, a new battle for the next massive increment of growth: the instant retail market. The ultimate winners and losers remain unclear, but this conflict will likely reshape the future of Chinese retail.

I envision the endgame of this war as a highly decentralized commerce landscape. Much like TikTok revolutionized the relationship between users and content through its algorithm—delivering more engaging, precisely matched videos and empowering a long tail of creators—this might also be the future of instant retail: a decentralized retail platform with TikTok-like mechanisms, dynamically connecting consumers with products and services (including countless SKUs) based on their location and real-time needs. By then, pure online retailers can distribute their goods to physical stores; omnichannel brands can place products in front warehouses; non-top-tier merchants can also reach more users by optimizing their products and promotion strategies...

Ultimately, this fierce battle may usher us into a new world of instant abundance.

Here are other notable brand updates currently on my radar 👇

Apple 📱 » In mid-August, Apple finally landed on Xiaohongshu / Xiaohongshu

In China, Apple has consistently maintained a restrained marketing approach, always being the last brand to adopt new marketing trends even amid intense competition. Will this approach still be effective this time?

Yun-Gui-Chuan Bistros » Trendy 'Yun-Gui-Chuan' Bistros under fire from experts for their fusion concept / China Daily

Seriously? Has this expert ever visited these restaurants to experience the ambiance and dishes firsthand? Has he actually spoken to the customers?

For consumers in eastern China, Yunnan, Guizhou, and Sichuan are three relatively unfamiliar regions to begin with, let alone their cuisines—especially the culinary styles of Yunnan and Guizhou. Before the cultural knowledge of these regions becomes more widely recognized, consumers simply won’t care whether the food is authentically from Yunnan, Guizhou, or Sichuan. If these dining brands can successfully combine elements from all three regions and develop a new category of cuisine that resonates with customers, consumers will undoubtedly embrace it.

LXJ 🍱(老乡鸡) » In July, LXJ submitted its prospectus to Hong Kong, initiating a new application after the previous submission expired on Jan this year / Caijing

LXJ is a fast-food enterprise operating over 1500 stores nationwide, regarded as the company with the most potential to become the "Chinese McDonald's."

Puma 👟 » Puma to be put up for sale, will Li-Ning or Anta be the buyers? / Jiemian

Let's wait and see...

Easyhome 🪑 » Wang Linpeng — The founder of China's largest home furnishing retail chain— Easyhome — died suddenly after being released from anti-corruption detention / Caixin

Public opinion on Wang's death is sharply divided👇

💀 Some view it as a fitting end for a corrupt entrepreneur who accumulated vast wealth through questionable means. They argue his suicide merely helped him escape what would likely have been a life sentence.

☀️ Others consider such harsh treatment of entrepreneurs unfair, seeing these business leaders as products of their era's corrupt environment rather than its architects. From this perspective, Wang and similar entrepreneurs made valuable contributions to China's economic progress and innovation, making his death a societal loss. These advocates believe such individuals should have the opportunity to redeem themselves by continuing to contribute to China's development.