A few things on my radar #20

Yunnan CoE; Auntea Jenny, Jiangsu Football City League and Xiaomi Vs Midea

👏🙋Hello, hello! Thanks for reading The Momentum — a reader-supported publication without ads or affiliate links. Feel free to subscribe to receive new posts and support my work!

Yunnan CoE ☕️

Qiupo Estate's washed Batian coffee bean won Yunnan's Cup of Excellence (CoE) Pilot auction, setting a domestic price record

On May 15th, Gems of Yunnan CoE Pilot ( 云南卓越杯试点赛) successfully concluded. From 36 competing beans, the international jury selected 19 award-winning beans scoring 87 points or higher. Finally, the top 10 specialty beans were chosen for offline auction to global buyers, with 100% of the proceeds going directly back to coffee farmers.

Qiupo Estate's washed Batian won first place, fetching an auction price of 13,150 yuan per kilogram, setting a record for the highest auction price of domestically produced green coffee beans.

China's coffee industry has developed at an extraordinary pace. The evolution spans the entire value chain—from chain stores and independent cafes to roasting expertise and barista skills—and now includes major advances in domestic coffee agriculture. Through this comprehensive transformation, China is evolving from a coffee-naive market into a potential coffee powerhouse

( Of course, Yunnan's soil and environmental conditions aren't ideal for coffee cultivation compared to world-class growing regions — this makes improving their bean quality particularly challenging and slow).

This illustrates why some global brands can't succeed with superficial "localization" strategies anymore—by the time they understand China's rapid pace of development, it's already too late, similar to what happened in the electric vehicle industry.

PS: To better understand updated Chinese coffee dynamics, I recommend an insightful analysis of China's coffee market from The Great Wall Street regarding Starbucks' predicament 👇

Auntea Jenny (沪上阿姨)🥤

Auntea Jenny, another Chinese bubble tea chain, hits $1.7 Billion on Hong Kong IPO

Despite China's bubble tea market being saturated with competitors engaged in fierce price wars, it has produced yet another billionaire couple. In May, Auntea Jenny launched its Hong Kong IPO, raising HK$273 million ($35 million) at HK$113.12 per share — the top of its price range, according to Bloomberg.

The company echoes some of these concerns in the prospectus, saying it faces increasingly intense competition with other leading players in various aspects of their business. However, the founder believes their product offering can help differentiate them from rivals, and venturing into markets outside China has become an inevitable choice for their further growth.

Be careful — the wave of bubble tea brands going public does not suggest a thriving industry. In fact, the bubble tea sector shows signs of growth anxiety—it faces more intense competition than coffee while experiencing significantly slower growth rates.

Among these bubble tea brands, only three currently interest me—low-end: Mixue (advantages in supply chain, cost, and scale), mid-range: Cha Gee (emphasis on culture, space, and design), and a high-end option not-yet-listed : HeyTea (product innovation and control of fresh ingredients). As for the others, in my view, their business models and product design are quite homogeneous — to stand out, they'll need to keep radical innovation in this competitive landscape.

Jiangsu Football City League (苏超联赛 / JSCL)⚽️

Jiangsu Amateur Football League Takes Off in Popularity Craze

The JSCL kicked off on May 10th, bringing together amateur teams from 13 prefecture-level cities. According to Xinhua, over 500 players aged between 16 and 40 come from various occupations—including students, teachers, delivery workers, and programmers—with each city fielding one representative team.

The league has gained popularity comparable to the viral Guizhou Village Super League (村超) and Village Basketball Association (村BA) from two years ago, drawing over 10,000 spectators per match—exceeding professional league attendance.

Many fans view JSCL as a domestic alternative to the UEFA Champions League (UCL), saying "While the Chinese Professional League suffers from match-fixing and backroom dealings, the amateur league in Jiangsu represents pure city-versus-city competition for genuine glory—embedded with true sporting spirit."

Unlike provinces centered on few megacities, Jiangsu’s thirteen fiscally autonomous cities foster balanced growth, breeding intense civic pride. This ignites intercity rivalries that naturally spill onto football pitches—where matches become cathartic celebrations of local identity.

Yet such grassroots success cannot obscure Chinese professional leagues' stark gap compared to elite league brands like the UEFA Champions League or NBA. Treating these amateur competitions as substitutes for top-tier leagues is more like a comforting lie we tell ourselves.

But this does not mean that Chinese football and basketball leagues are without hope - such grassroots momentum subtly signals a larger ambition. If the authorities can strategically consolidate these fragmented grassroots programs, it will form critical nodes in a national talent development matrix—transcending mere entertainment to become engines for mass youth engagement and elite athlete identification.

20 # Midea vs Xiaomi 🏡

Midea's CEO publicly claimed that Xiaomi's expansion into home appliances is a mistake

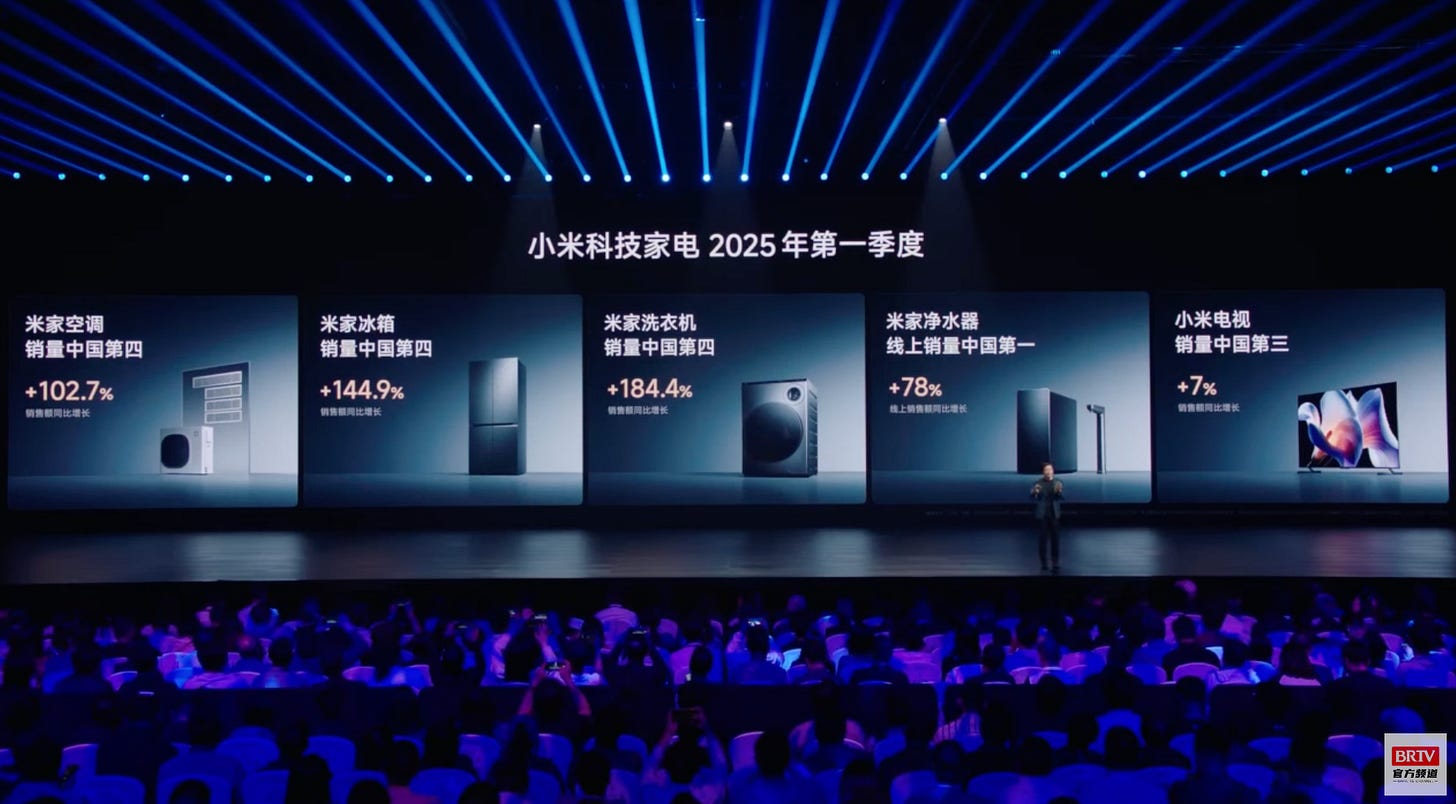

Following introduction of the "Human-Vehicle-Home" strategic ecosystem and MiMo LLM, Lei Jun showcased unprecedented chip breakthroughs and strongly emphasized the importance of home appliances in Xiaomi's strategic roadmap at their recent product launch event.

Midea's CEO Fang Hongbo criticized Xiaomi's entry into all of Midea's market segments, while claiming any new competitor has already lost strategically. "Xiaomi has entered all of our segments.." Fang said, "I take Xiaomi seriously on a tactical level, but strategically, I'm not afraid of Xiaomi's entry"

Far from being a mistake, Xiaomi's strategy is completely sound. Home appliances represent a crucial touchpoint in daily life and form an essential part of Xiaomi's hardware-software ecosystem with its exceptional price-to-performance advantage. Midea's announcement seems more like a helpless complaint — they appear to have not produced any exciting innovations for a long time.

Here are other notable brand updates currently on my radar:

Momenta 🚗 🤖» Uber and Momenta announce strategic agreement for Robotaxi deployment in May / Uber

Momenta is currently recognized in the industry as a first-tier autonomous driving technology provider alongside Huawei, with its strength lying in algorithms — a company worth watching.

Quchashan (去茶山) » ⛰️🥤A regional fresh-made tea brand from Guizhou suddenly becomes a hit in Shanghai / 36Kr

Quchashan is Guizhou's signature fresh-made tea brand, which focuses on exploring local ingredients from Yunnan and Guizhou. I really like their product concept, as discovering unique materials and ingredients is crucial for standing out in a fiercely competitive market. However, with only 63 stores nationwide as of May, their scale remains small and poses limited threat to major bubble tea chains.

Moutai 🍶 » Moutai's overseas market revenue grew 37.53% YoY, according to their Q1'25 result / Yicai

To truly earn global respect, Moutai must reinvent Chinese alcohol culture.

Ludao (鹿岛) 👖🩲👕 » A brand that truly rivals UNIQLO in quality, yet costs less, has finally emerged / Genbridge

Unlike Bananin (蕉内), which has long been perceived as China's UNIQLO alternative yet offers increasingly expensive products with poor quality, Ludao truly fills this role with their T-shirts priced at ¥19.9 and reasonably good quality.

JD 🥡🛵 » Beijing summons JD, Meituan, and Eleme over excessive competition in food delivery / SCMP

As mentioned in my previous post, Meituan's monopolistic position isn't something the CCP wants to see. This is why I see the tripartite talks essentially functioned as a market share distribution meeting.

Thanks for the shoutout Sam! Appreciate it!