A few things on my radar #15

Baidu, XPeng and Walmart

👋 Hello hello! Thanks for reading The Momentum. Subscribe for free to receive new posts and support my work!

Baidu 🔍

Baidu's earnings drop, but Apollo Go is on the path to profitability

Despite strong growth in its AI Could business with 26% yoy growth, Baidu's fourth-quarter revenue still declined 2.4% to $4.70 billion as operating income fell 29% annually, driven by a hefty 7% decline in Baidu Core Ad sales.

To win the AI battle, Baidu has launched two new AI models on Mar 16th — Ernie 4.5, the latest version of the company's foundational model first released two years ago, and a new reasoning model called Ernie X1. According to Reuters, Baidu claims that Ernie X1's performance matches DeepSeek R1 at half the cost, while Ernie 4.5 boasts "high EQ," enabling it to understand memes and satire.

Moreover, Baidu has expanded into self-driving technology in search of new growth opportunities. The company reached a milestone last November when its Apollo Go robotaxi service received permits to test autonomous vehicles in Hong Kong, and they expect Apollo Go to achieve profitability by 2025.

Let's be straight — the core challenge with Baidu now is the serious deterioration of its core search business and strategic missteps in AI that led to losing its first-mover advantage especially in LLM competition.

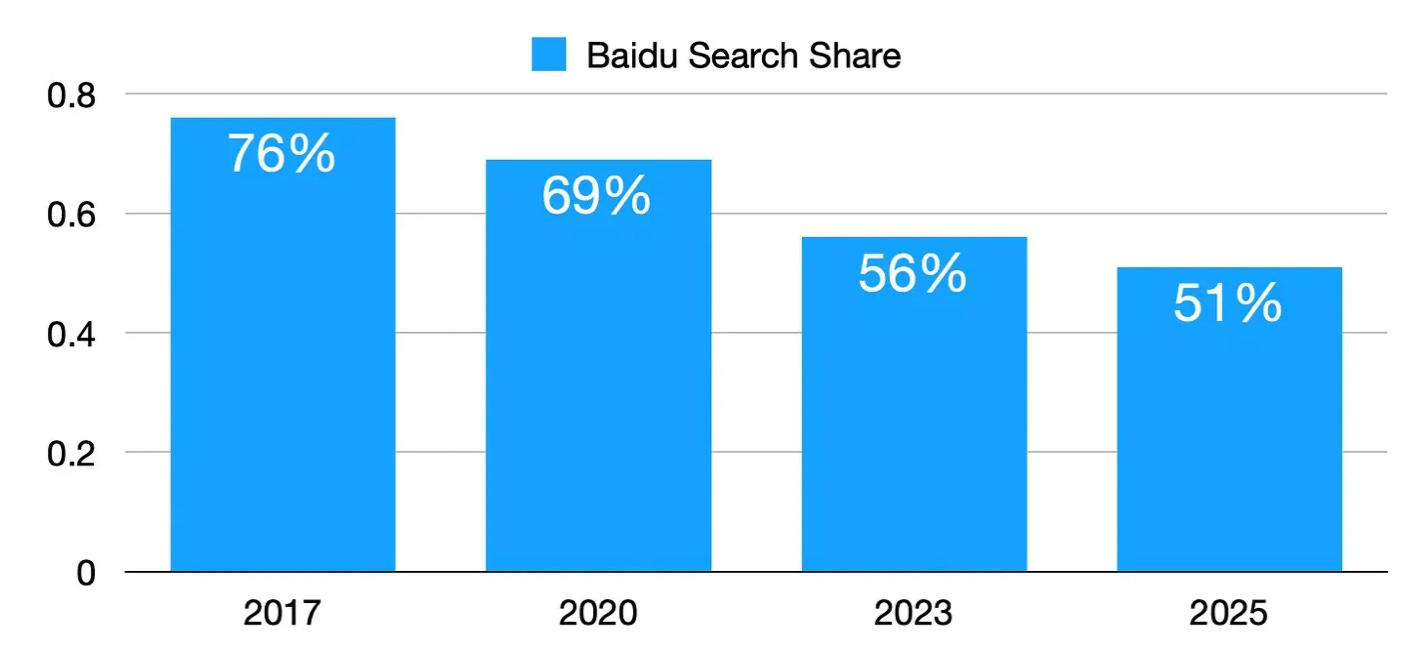

In fact, many may not have noticed that Baidu's search business crisis has been declining gradually for years. During the mobile era, platforms like Toutiao, WeChat, Taobao, and RedNote have been attempting to evolve into Super Apps, while creating information silos that prevent others access, including Baidu. This isolation makes the information aggregator ecosystem on Baidu almost collapsed — leading its search share has plummeted from 76% in 2017 to 52% today.

You might wonder why this dramatic decline in market share hasn't significantly impacted their advertising revenue until this recent quarter? — because their ad revenue includes not only search advertising, but also brand advertising and news feed advertising developed after 2017 as supplementary revenue streams.

Now, with domestic AI booming, a new challenge has emerged — AI-powered search products like Deepseek, Quark, and Tencent Yunabao are delivering more relevant and intelligent results than traditional search engines, further eroding Baidu's market share. This time, neither branding nor feed ads are likely to offset these losses.

In an effort to counter declining revenue, Baidu is attempting to leverage its AI capabilities to stay competitive in search, following its competitors' lead. However, despite being an early entrant in the field, their AI models have never shown any remarkable features.

Despite triggering a stock price surge, their latest LLM offers nothing substantial upon closer inspection — there are no benchmarks showing that Reasoning X1 and R1's capabilities are on par, even though Baidu claims so, while Ernie 4.5 is just about the same level as DeepSeek V3, nothing special. To me, this release simply shows Baidu playing catch-up with competitors on LLM. It's great but not related to any genuine innovation.

Perhaps now only has intelligent driving left that's worth showing off.

The "Apollo Go" — their robotaxi service integrated with its powerful map navigation application — has already entered multiple cities, especially in Wuhan, where it has practically become the city’s calling card and is expected to approach profitability soon. This could make Baidu the first Chinese company to successfully establish a viable profitability model for robotaxi. If Baidu can eventually expand its autonomous driving business on a large scale nationwide, this could become one of the company’s few standout features where it leads its peers, at least at the application level.

XPeng 🚗

XPeng aims to achieve profitability in 2025 and plans to start selling robots and flying cars by 2026

XPeng's February sales surged 570% year-over-year to 30,453 vehicles, driven by strong demand for the P7+ and MONA MO3 models. In comparison: NIO rose 62%, Li Auto increased 30%, BYD grew 161%, while Tesla declined 49%.

The company is expected to achieve profitability by late 2025, driven by new model demand and overseas expansion. If successful, XPeng would become China's first pure EV maker to turn profitable, said Reuters.

Xpeng even plans to start mass production of its flying car model and industrial robots by 2026.

Like Tesla and Baidu, Xpeng has developed its own AI models for advanced autonomous driving. By the second half of this year, Xpeng plans to achieve L3 full-scenario autonomous driving, promising an unparalleled driving experience.

He Xiaopeng, the leader of XPeng, should be grateful to Wang Fengying (王凤英)—this veteran auto industry executive joined XPeng in early 2023 when the company was facing a sales crisis. Drawing on her extensive experience, she orchestrated a sweeping overhaul of XPeng's core products, sales system, and supply chain, rescuing the company from its slump and steering it back onto the path to profitability.

Having resolved its survival challenges, Xiaopeng's visionary ambitions have taken flight - from last year until now, XPeng has successively launched an AI-powered in-car OS (2024), iron robots (2024), and even revolutionary flying cars (2025) that have caught everyone's attention. With the government's growing emphasis on AI, robotics, and the low-altitude economy this year, all of XPeng's innovative directions show tremendous potential.

Think large — in contrast to XPeng and the broader EV industry in China showing strong performance, Tesla's sales continue to decline in major regions like China and Europe. This appears to validate analysts' concerns about Elon Musk's ability to juggle multiple roles while maintaining Tesla's competitive edge. Given this situation, Chinese EV makers are well-positioned to gain Tesla's market share, both domestically and internationally.

BTW - if you're interested in China's low-altitude economy updates, I recommend checking out this Substack: — China eVTOL News — the author is a Canadian professional journalist who has focused on the aviation industry for over a decade.

Walmart 🏬

Walmart faces pressure in China as Trump's tariffs take effect

To cope with a 20% tariff on Chinese imports on top of previous tariffs has put U.S. retailers, in recent weeks, Walmart and other U.S. retailers have told some suppliers they want discounts on China-made products. Some suppliers have also been asked to move production outside of China.

Chinese officials confronted Walmart last Tuesday over reports it was pushing Chinese suppliers to offset U.S. tariff costs through price cuts. The state media further noted that Walmart sources 60% of its products from China and warned that mistreating Chinese suppliers risks consumer backlash.

According the WSJ, during Tuesday's meeting, Walmart pledged to work collaboratively with Chinese suppliers while protecting mutual interests. The company emphasized China's importance as a key market and crucial supply chain partner.

Thanks to Trump's tariffs, global trade patterns are being further reshaped.

I'm not sure to what extent this will affect Walmart's business in China - it largely depends on how Walmart ultimately handles this dilemma.

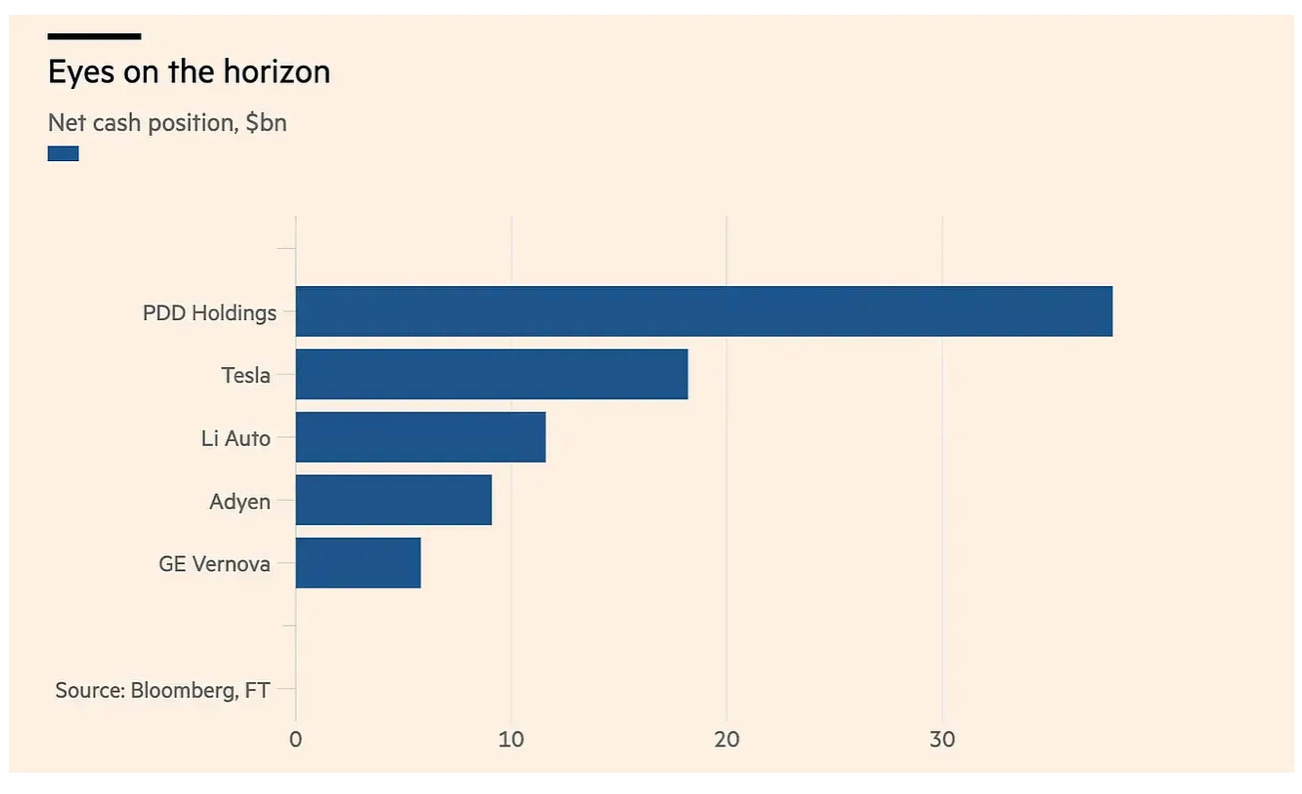

In the end, it reminded me of a widely discussed question - Why does PDD maintain such a large cash reserve? IMO, one possible reason is — beyond hedging against domestic economic uncertainties, they need to save more to weather such increasing serious geopolitical challenges since overseas business is very important to PDD.

Here are other notable brand updates currently on my radar:

Luckin >> Luckin does not plan to raise prices, despite the surging cost of beans // Yicai

Despite Luckin Coffee's significant supply chain advantages from its massive purchasing power, the company faces unavoidable cost pressures as green bean prices have nearly doubled this year. Their announcement of "no plans to lower prices" seems to be a defensive warning signal to Cotti - the instigator of the ¥9.9 price war - indicating that if the price war continues, they still have the capacity to fight till the end.

Mixue >> Mixue has won widespread forgiveness and support domestically, despite being criticized on hygiene violations issues by the state media // ThePaper

In my memory, this is the first time in history that a brand called out during the 315 broadcast was forgiven by consumers without taking any remedial measures - Mixue's supporters have essentially become the brand's free "PR army" - so crazy.

H&M >> H&M takes back its flagship Shanghai store // WWD

For H&M, rebuilding trust with local consumers is the top priority now.

Sabrina Ionescu >> Ionescu has met her fans in Manila, Guangzhou and Hong Kong // Weibo

With increasing WNBA viewership, women's basketball players have established themselves as true stars and are actively expanding their influence in Asian markets.

Thank you so much for the shout out!

Do you genuinely think Baidu can succeed in autonomous driving? My main criticism of Baidu has always been their poor operational performance. They’re often first movers, yet consistently fumble the execution—just like they did with their large language model, opting for monetization instead of open source, allowing others to dominate.

Considering the intense competition from companies with proven operational strength now entering the autonomous driving market, I’m wondering if Baidu can really pull this off.