A few things on my radar #14

ChaGee, JD and __FC Universe

👋 Hello hello! Thanks for reading The Momentum. Subscribe for free to receive new posts and support my work!

ChaGee 🥤

ChaGee, another major Chinese bubble tea chain, is following Mixue's Hong Kong IPO path with plans to list in New York

Chinese tea-drink brand Chagee has secured approval from the country's market regulator for an IPO n the US, just days after competing chain Mixue made its blockbuster debut in Hong Kong, though the listing date has not been set, said SCMP.

Founded in 2017 in Yunnan province, ChaGee has established itself through a diverse milk tea menu and branding rooted in traditional Chinese culture. According to its official website, the chain operates more than 6,500 locations globally, including 150 stores across Malaysia, Singapore, and Thailand.

During an industry event in last May, the founder revealed that Chagee's first-quarter sales had reached 5.8 billion yuan and projected that their full-year revenue would surpass Starbucks in China.

In my newsletter last year, I mentioned their goal of becoming the Starbucks of the east, and they are truly following through on their word. Just look at their logo, store model, and locations. Except for not selling coffee, they are practically repackaged twins with Starbucks in all other aspects

Of course, copying Starbucks' formula doesn't guarantee success. As of the end of last year, ChaGee operated only 6,000 stores — with just 150 outside China — while Starbucks China alone has over 7,000 stores. Meaning, if ChaGee wants to replicate Starbucks' success story, they need to put in much more effort in international markets.

Will Mixue's success in Hong Kong make people reevaluate Chinese bubble tea companies, making ChaGee's path more smooth to a U.S. IPO? Who knows—let's see what happens next.

JD 🛵

JD is expanding into the food delivery sector as the CCP maintains its antitrust investigation of Meituan

Chinese regulators indefinitely extended Meituan's antitrust "rectification period" beyond October 2024, as the company continued preventing restaurants from using other delivery platforms, according to Nikkei.

Capitalizing on Meituan's regulatory challenges, JD has strategically entered food delivery by offering premium service — featuring strict food safety standards, quality restaurant partnerships, and offering social security for riders.

JD's entry strategy targets almost every longstanding industry pain point, benefiting all stakeholders in the business chain including consumers, restaurant owners, and frontline workers. This framing places the company on moral high ground, winning widespread user support across the internet.

However, many analysts remain skeptical of JD's ability to compete with Meituan, which commands 64–67% market share, maintains a robust 30-minute delivery network, and possesses extensive logistics expertise developed through years of "food delivery wars"

Although JD's capabilities in the food delivery sector lag far behind Meituan's, regulatory factors make it worth watching. The CCP's deliberate extension of the investigation signals trouble for Meituan—indicating an intent to restrict rather than support their dominant position. This creates a potential opening for competitors like JD.

This explains JD's bold declaration of war right now, where every statement attacks Meituan's weaknesses—not because of JD's food delivery prowess, but because JD knows they can pressure Meituan publicly while Meituan is unable to openly fight back at the moment.

Apple

Apple teams up with Alibaba to create AI features for Chinese users, which is a positive signal for Apple's sales in China

Screenshot — Jack Ma appeared on Xianyu on February 11th, the same day The Information announced Apple and Alibaba's partnership - he looks happy, but for some reason he's gained weight - probably from resting too long.

According to The Information, citing sources with direct knowledge of the decision, Apple has partnered with Chinese internet and e-commerce giant Alibaba Group to roll out artificial intelligence features in China.

Apple began testing AI models from leading Chinese developers in 2023 and initially selected Baidu as its primary partner. However, the collaboration hit roadblocks when Baidu's development of models for Apple Intelligence failed to meet Apple's standards.

Apple recently evaluated AI models from multiple Chinese companies including Tencent, ByteDance, Alibaba, and Deepseek. While Deepseek was ruled out due to limited resources, Apple found most models struggled with understanding user context. Alibaba was ultimately selected due to its extensive consumer data from e-commerce and payment services.

Some analysts argue that AI features won't significantly boost iPhone sales, pointing to Europe's growth surpassing that of the U.S. last quarter despite the absence of Apple Intelligence (except for a brief period in the U.K. in December). However, this perspective overlooks the "national pride" factor at play in China.

Today, many Chinese consumers view domestically developed AI products as national champions, much like Huawei. This sentiment could generate significant interest in iPhones equipped with local AI technologies—whether Qwen, DeepSeek, or DouBao—as long as Apple avoids partnering with Baidu, a company widely despised by Chinese users for its unethical advertising practices.

___FC Universe 🎉

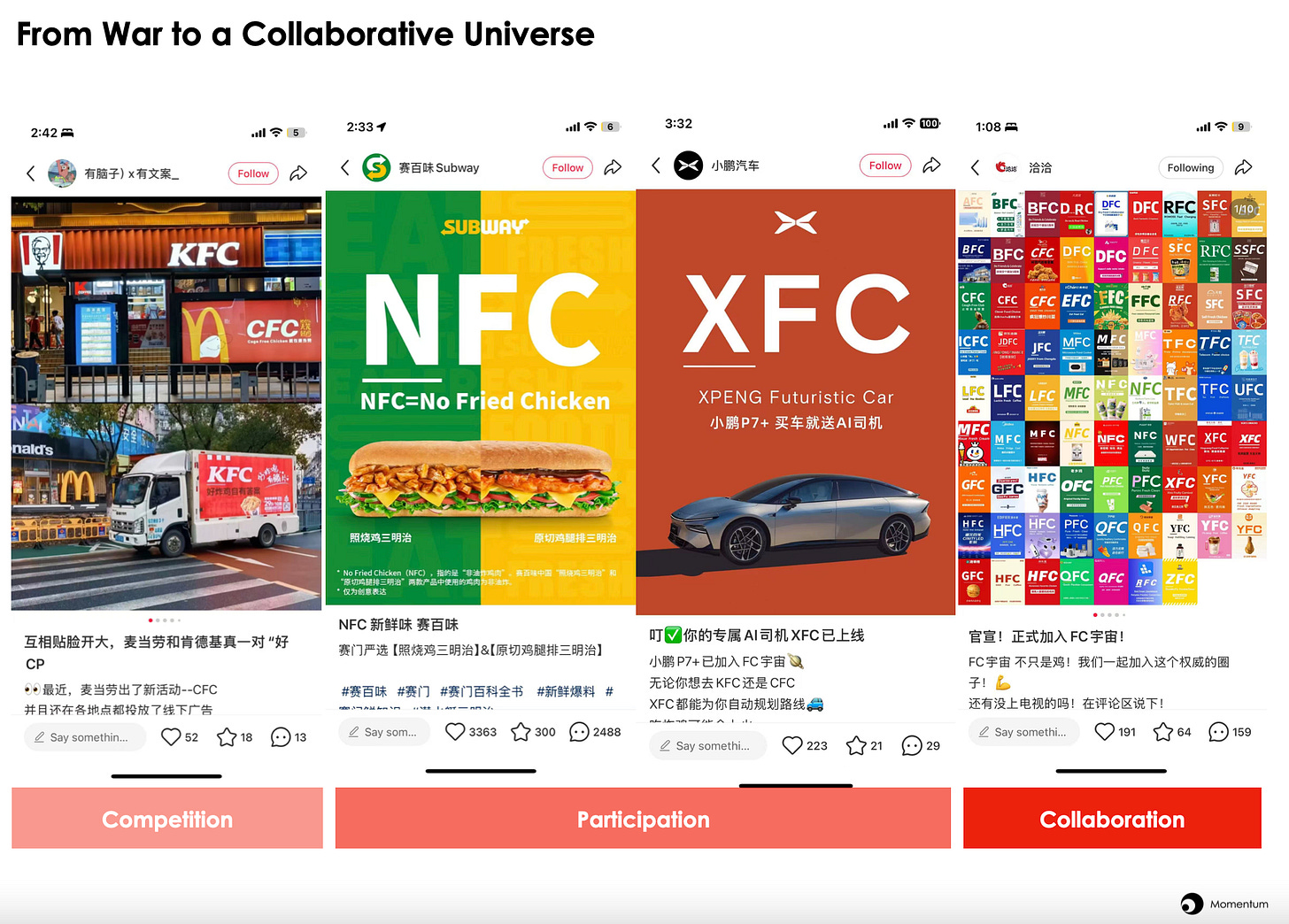

A “fried chicken war” between McDonald's and KFC has unexpectedly transformed into an unprecedented brand carnival across Chinese social media

As I mentioned in my last newsletter, McDonald's launches "CFC — Cage Free Chicken" campaign provoking KFC's main course in China last month. McDonald's not only emphasized the superior quality of their chicken ingredients in their advertising, but also deliberately used the FC initials to place ads that looked like KFC's right in front of KFC's stores.

To fight back, KFC set off an overwhelming advertising campaign that highlighted their handcrafted fried chicken techniques and emphasized the "K" in "KFC" to defend their position as China's fried chicken leader.

Alongside the war between two big chains, some catering brands also join the game by capitalizing on the "chicken" topic to showcase their own chicken quality. For example, Subway created an "NFC" poster, claiming their meat is "No Fried Chicken."

Now, surprisingly, what started as a brand war over chicken has lost its competitive atmosphere — it has transformed into a collaborative campaign where countless brands are joining forces to build the "__FC" universe by offering their own creative answers to fill in the “__” blank.

This represents an unexpected turn in the chicken war — branders here have transformed a brutal battle into a grand cyber artistic masterpiece.

What can I say — there are no winners or losers in this "__FC" game. Thanks to McDonald's and KFC, this epic spectacle triggered by you two will go down in Chinese advertising history.

The creative collaboration between brands across China offers a powerful lesson for political leaders during these turbulent times — that beyond win-lose conflicts, there exist countless opportunities to collaborate and create something new and excited, if only we choose to embrace them.

Here are other notable brand updates currently on my radar

Laopu >> Shares of HK-listed jewelry brand Laopu Gold soar to record high // Reuters 💍

Laopu's success is no coincidence. Its premium niche strategy stands out uniquely among boring chain competitors - The analysis I did of Laopu last year still holds true today.

Moutai >> Despite Moutai’s projected 15% revenue growth for 2024, the luxury baijiu sector grapples with price declines, changing tastes, and trade tensions //JingDaily 🍶

I hate baijiu culture so much, but I recently bought a lot of Moutai for fun (which might sound crazy when it is facing a downturn) - I may tell you the reason later in my work.

Manner >> Manner Coffee, which is now solely on direct operations, is quietly exploring the possibility of franchising model // Chinese entrepreneurs' magazine ☕️

Franchising in catering business is a double-edged sword — Mixue's success with its supply chain-driven franchising model and HeyTea's reluctant franchise contraction perfectly illustrate this point. With so many precedents to learn from, I believe Manner would be more cautiously about their franchising plan.

Mixue >> Mixue's founders were nowhere to be found at their HK debut, with their Snowman mascots taking center stage // Douyin ⛄️

The Zhang brothers deliberately avoided public attention by not even appearing on screen during their company's debut. Instead, they let their mascot take the stage for the bell-ringing ceremony—making them even more mysterious than DeepSeek's founder.

If you're interested in Mixue's story, please check this out.

First Pet & Fresh >> After leaving Alibaba, Freshippo's founder Hou Yi has launched a pet food grocery brand in Shanghai with ambitious expansion plans // Yicai 🦴

It sounds interesting, but since I haven't visited yet, I'll share my thoughts after checking it out.