A few things on my radar #1

Figures; Food and Beverage; Retail; Sports and Entertainment

FIRGURES

The total retail sales up 3.1% YoY in March.

In March, the total retail sales of consumer goods was 3.902 trillion yuan( 0.55 trillion U.S. dollars), up 3.1% YoY – 3.9% YoY excluding autmobiles. Among them, catering accounted for 10%, up 6.9% YoY.

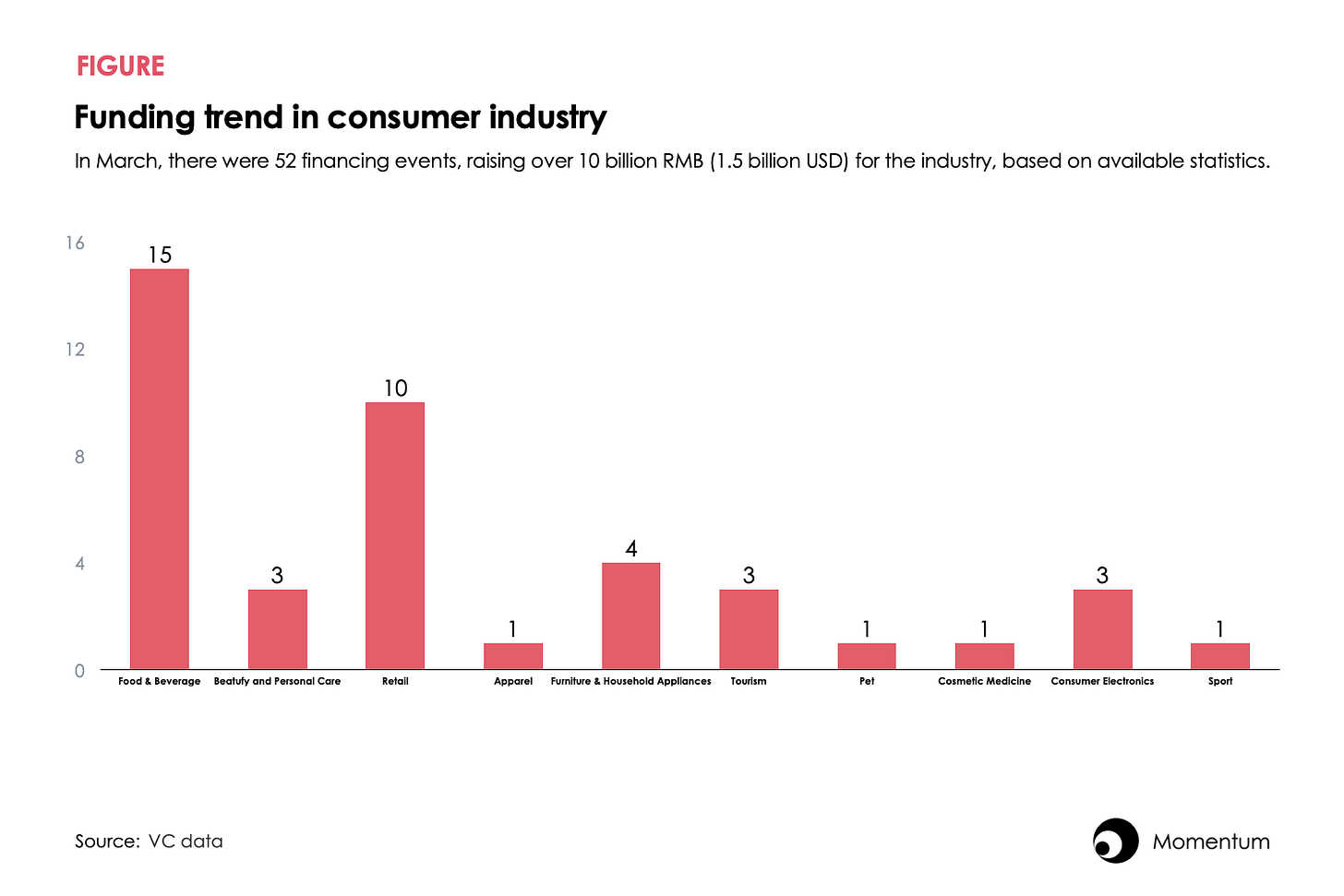

Venture capital continues to invest in consumer industry.

Based on available statistics, 52 funding events were held in March, raising over 10 billion yuan (1.5 billion U.S. dollars), an increase of over 60% compared to March 2023. The food and beverages, and retail sectors, were most active in securing financing.

FOOD & BEVERAGE

Shares of China’s third-largest bubble tea brand Chabaidao slumped on HK debut.

WSJ reported that Chabaidao's share price dropped to a low of HK$12.80 in their trading debut Tuesday, which is a decrease of 27% from its IPO price of HK$17.50.

A strategist from IG, a trading platform, believes that Chabaidao's poor performance reflects investor’s concern for its future growth. This is the result of China's economic downturn, a decrease in HK's attractiveness, and strong local competitors also seeking expansion.

Bloomberg pointed out, in addition to Chabaidao, at least six other bubble tea companies in China are preparing to go public in HK or the US.

Frost and Sullivan, a US business consulting firm, expects the Chinese fresh-made tea market to grow 15% annualy over the next five years to 540 billion yuan by 2028.

In fact, globally, there isn’t a bubble tea brand that matches Starbucks' status in the coffee industry. Meaning, there is a void in the market and Chinese venture capitalists and bubble tea companies have been active to exploit it.

Notably, Chabaidao and its peers are all well-profitable. Therefore, a poor performance when going public, like Chabaidao's, likely won't stop the milk tea market from continuous expansion.

Seesaw, the first batch of coffee brands to bring specialty coffee culture to China, is shrinking their business.

Early this year, Yicai reported that they have shut down more than 30% of their storefronts, with only about 100 stores remaining. What's to blame? Yicai cites an intense price war in the industry.

Seesaw's positioning is misaligned with the market. Pricing aside,the Seesaw team has allocated insufficient resources to the supply chain, as stated by Tech Star.

In my view, the true reason for the failure is their weak product proposition — in expanding their stores, they have ignored supply chain and product innovation, making them undistinguishable and lackluster.

Let's face it, Mstand, their direct local competitor, sells coffee at a 20% higher price than Seesaw and operates three times as many stores.

The takeaway: Consumers care about the coffee experience, not the business scale.

Grid, a Chinese premium coffee chain known for their exceptional SOE coffee, featured in Gucci’s March co-branding campaign.

Alongside Grid, Gucci also featured two other internationally renowned specialty coffee brands - Blue Bottle and Arabica, reported by Showcase

The founder of Grid stated, "Our overall price is around 30 yuan, which is a mid-to-high price in the market. We want to popularize specialty coffee - turning specialty coffee from something I need to go out of my way to drink, into something that can be consumed daily.”

Grid aims to satisfy consumers' needs for both convenience and high-quality coffee. This strategy is smart but requires careful execution. It is essential to invest into the products and supply chain to ensure high-quality coffee. Grid should tread lightly and not make the same mistake as Seesaw.

Electro X, a sports beverage brand, received Series A investment from Sequoia China in March.

Electro X, provides natural soda water and flavor-free electrolyte drinks, obtained an undisclosed amount of A-round financing from Sequoia.

Unlike other sport beverage brands, they are specifically targeting urban white-collar outdoor sport lovers.

Given the fact that Chinese consumers prefer healthy drinks, and their affinity for outdoor sports, Electro X could be on the verge of a significant breakthrough.

McDonald's is accelerating its localization in China.

They have recently partnered with Sanxingdui Museum, celebrating the local heritage and food culture of Sichuan. As part of the collaboration, they launched a Sichuan flavored burger with a special packaging featuring cultural relics.

McDonald's localization appears to be mirroring KFC's past efforts, in both product and marketing.

Ok…we may see rice or Peking duck on McDonald's menu very soon.

RETAIL

KKV, a Chinese lifestyle retailer, is expanding its footprint from the mainland to Southeast Asia.

According to Yahoo Finance, KKV has over 800 stores across China, Indonesia and Malaysia.

KKV carries an extensive range of up to 20,000 SKUs, comprising both popular imported brands and rising Chinese labels, specifically catering to Gen Z's tastes.

According to YouTuber and retail insider Aunty Uncle, the KKV store in Kuala Lumpur often runs out of stock due to its well-designed and affordable offerings.

KKV already faces stiff competition from powerhouses like Minsio, Daiso and Muji. Is there enough space in the global market for KKV to survive? Or is this overnight capital bubble likely to pop?

Jack Ma's latest memo urges Alibaba to capitalize on AI opportunities.

Jack Ma's recent internal memo shows his support for Alibaba's reforms, acknowledges past mistakes, and encourages employees to seize AI opportunities.

Prior to Jack's internal memo, in an interview with the CEO of the Norwegian Sovereign Wealth Fund, Alibaba's current Chairman, Joe Tsai, also stressed the significance of AI for Alibaba's future.

SCMP reported that Alibaba is promoting AI tools to assist merchants in boosting sales.

Meanwhile, Alibaba had already developed a new shopping app for Vision Pro prior to its launch.

Alibaba is placing a bet on e-commerce via AI innovation to lead them in a new direction.

Despite Vision Pro's clumsiness, continued investment from companies like Apple and Alibaba may popularize wearable shopping devices . Early contenders like Alibaba could take advantage of this new shopping trend to regain industry leadership.

SPORTS & ENTERTAINMENT

Blizzard successfully returned to China on April 10th.

In 2023, Blizzard left China after a falling out with their local publisher NetEase due to a disagreement over licensing rights.

Blizzard asked NetEase for a six-month contract extension while looking for other partners. NetEase rejected the request, resulting in the shutdown of Blizzard Games, including World of Warcraft (WOW).

Chinese fans expressed their disappointment over the loss of their longtime pastime as many of them had grown up with the WOW.

In Oct. 2023, Microsoft acquired Blizzard and managed to reach a new deal with NetEase on Blizzard’s return.

This comeback has sparked heated discussions on social media - some expressed their welcome, but many gamers also expressed feeling betrayed.

It is no longer a question of whether Blizzard or NetEase was at fault. Players have only cared about one thing - the gaming experience.

In terms of a comeback, Blizzard might be facing an uphill battle.

There is a high entry for new players to join the game. In terms of convincing old players to return, Blizzard needs to mend relationships with these players and restore their data.

A CBA team hindered Yang Hansen’s future opportunities in the NBA.

Yang Hansen (杨瀚森) , a current CBA player, was ranked 38th and picked by the Memphis Grizzlies in The Athletic's 2024 mock draft.

In early April, according to Yang’s team, Qingdao Eagles, Yang is not going to join the NBA draft because he is not NBA-ready. However, a sport commentator stated that the Qingdao Eagles played a role in influencing Yang’s decision to forgo the NBA draft.

Everyone knows this would have been a golden opportunity for Yang to go to the NBA draft. If the Qingdao Eagles had a more strategic long-term vision, they could leverage Yang’s participation in the NBA to benefit them down the road.

Having a player like Yang go to the NBA will ultimately benefit Qingdao and the CBA as a whole when he comes back.